Pulse Market Insight #162 JAN 19 2018 | Producers | Pulse Market Insights

US Pulse Crop Gleanings

Although the US pulse harvest is well past, the USDA recently issued its final (in some cases, its only) estimates of 2017 crops. Traders have already developed their own “feeling” of crop size based on farmers’ willingness to sell as well as word-of-mouth reports. That said, there are still some interesting tidbits of information in the reports that could help shape the market outlook.

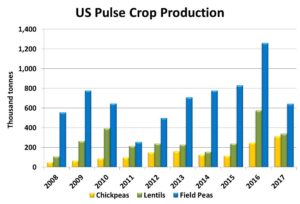

Even at planting time, the 2017 US pea crop was already expected to be lower than the year before. Seeded area was down 18% but yields also ended up 28% below average at only 22.5 bu/acre. The result was a 2017 crop of 643,000 tonnes, half of the year before. Just like in Canada, US pea acreage had shifted from greens to yellows, so the decline will hit the green side of the market even harder. Roughly 400-450,000 tonnes of the US crop are normally consumed domestically, including four livestock feed and pet food. This means there aren’t a whole lot of peas left for the export market. While the Indian market is essentially shut down, US peas will be less of a competitor in other countries as well.

Based on plantings, the 2017 US lentil crop was expected to be larger than the year before and seeded area was up 18% over 2016. The problem was that lentil yields dropped to 730 pounds per acre, 43% below the 5-year average. The net result was a 2017 lentil crop of 339,000 tonnes, 41% lower than the year before. This won’t have any real effect on the red lentil market as US growers mainly plant greens. As a result, the drop in the US crop will mean less competition in export markets and (partly) limit the declines in green lentil prices.

Chickpeas are one crop that still saw higher production in 2017. Largely that’s because planted area was 90% higher than the year before. Yields dropped to 1,150 pounds per acre, 23% below the 5-year average but that wasn’t enough to offset the spike in acreage. The 2017 US chickpea crop was 27% larger than the year before, but it could have been much more. The earlier ideas of a huge increase in US chickpea production had raised concerns about demand for Canadian chickpeas, as the US is Canada’s largest buyer. The smaller-than-expected crop should mean a ready market for the few remaining Canadian chickpeas in the rest of 2017/18.

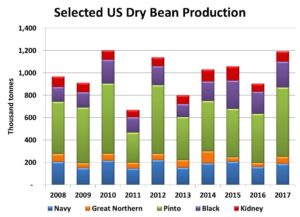

The US dry bean crop saw surprisingly large yields even though crop condition ratings in the summer suggested yields might be reduced. The total 2017 crop (excluding garbanzos) was 1.3 million tonnes, 24% more than the year before. For some classes, there was less of an increase but for the major types grown in Canada, navy beans were up 18%, great northerns up 66%, pintos up 41%, black beans up 17% and 26% more kidneys.

These larger bean crops mean more competition for Canadian beans although Canadian exports in the first few months of 2017/18 have been quite strong. Still, it will limit US purchases of Canadian beans which can at times be fairly significant.

Some of these factors are already influencing markets, but others will take a while to play out over the course of 2017/18. And of course, some of these developments are being overshadowed by the situation in India which is clouding the overall market picture.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.