Pulse Market Insight #164 MAR 6 2018 | Producers | Pulse Market Insights

Are There Already Signs of Life for Peas?

Looking at some news reports about this year’s pulse trade could convince you to write off the entire 2017/18 marketing season for peas. While things certainly aren’t great right now, I would suggest it’s too soon to give up on marketing the 2017 pea crop. That’s not to say there will be a screaming rally in the next few months but there are hints of a light at the end of the tunnel.

Of course it’s the slowdown in Indian imports that’s the main concern. The 50% tariff for pea imports on November 7, 2017 was the big news, but Canadian exports to India had already started to slow down sharply back in July and August. Even in the typically heavy export months of September and October, volumes weren’t even close to average.

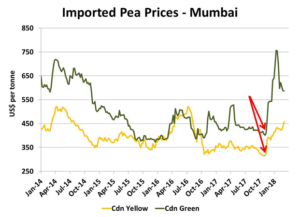

When India imposed the tariff, it shut off nearly all pea imports and had its expected effect on prices, although the impact was different on the two classes. Yellow pea prices in India immediately rose US$75 per tonne and continued to climb from there. Just this past week or two, prices were up another US$35 per tonne. Those are important market signals.

The impact on green pea prices was far more dramatic. From a low of US$400 per tonne just before the tariff, prices shot higher to US$755 by early January. Since then, prices have come off that peak but are still at multiyear highs. And the reason green pea prices retreated from the high was that Indian traders were importing green peas in spite of the 50% tariff.

These stronger prices are a clear signal that Indian pea stockpiles aren’t as large as some were thinking. Slower imports over a number of months had already drawn down supplies. The Indian rabi pulse crop is being harvested now and it will bring in another sizable pea crop but not enough to meet demand. And few if any Indian farmers grow green peas at all, which makes the country entirely dependent on imports for that type. That’s why green pea prices spiked higher.

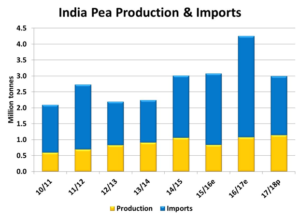

Even though Indian farmers planted more peas than ever before, raising the potential for a new record, it still won’t be enough. Over the past three years, Indian consumption (estimated as production plus imports) has been at least 3.0 million tonnes. If this year’s domestic crop is a little over 1.0 million tonnes, it means India would have enough peas for about four months of consumption.

The result is that India will need to start importing yellow peas again within a few months. That’s on top of the green peas it’s already importing. Canadian yellow peas could start moving again to India by later this summer, but it won’t be all smooth sailing.

In the past few years, other countries have boosted pea production as well so competition will remain strong for the Indian market. And with so many Canadian farmers still holding large old-crop supplies and ready to sell, prices may not improve all that much. Still, it’s good to know there is some room for optimism in the pea market.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.