Pulse Market Insight #173 JUL 20 2018 | Producers | Pulse Market Insights

Is There a Light at the End of the “India Tunnel”?

The old saying goes that it’s always darkest before the dawn, and that’s a little bit the way pulse markets feel right now. India has slammed the door shut on pea imports and put import tariffs on other pulses. Bids for peas and lentils in western Canada are heading lower, although some of that is normal seasonal pressure. Even so, prospects for a heavy off-the-combine export program seem somewhat dim.

We know that at some point, the situation will resolve itself, likely through lower Indian pulse production. But predicting exactly when that will happen is difficult, especially when seemingly arbitrary government decisions are causing most of the issues in the market.

We certainly don’t want to raise hopes unnecessarily, but there are a few glimmers of hope coming out of the Indian market. One big caution though is that even if these market signals are positive, we’re not expecting a large or a quick rebound. In fact, with the Canadian and US harvests coming up within weeks, prices could get worse before they get better. And farmers may be disappointed with the size of the recovery when it does show up.

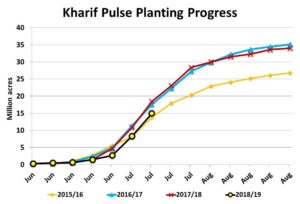

The first signal that India may need to come back to the market for pulses is the slower pace of the kharif (summer) planting season. The official explanation is that the slow arrival of monsoon rains is discouraging farmers from planting pulses, but low Indian prices aren’t helping either. So far this season, seeded area is trailing last year by 19%. Keep in mind that the kharif pulse crops aren’t peas, lentils or chickpeas, but this still indicates that Indian farmers are responding to low prices by cutting acres. Smaller Indian crops will eventually provide some support for prices and persuade the Indian government to allow imports.

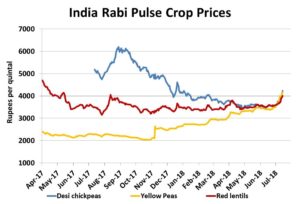

The second, and more telling, sign of optimism is the recent increase in Indian prices for rabi pulses. Yellow pea prices had been strengthening for some time but had been held back by flat prices for chickpeas, the main substitute for yellow peas. More recently, those chickpea prices have also started to move higher as have red lentils. Green pea prices aren’t shown on the chart but have absolutely skyrocketed to over US$1000 per tonne.

All of these price increases are signaling that pulse supplies are starting to tighten up in India. This means imports will be needed at some point, although we don’t expect a quick turnaround. The resumption of some pulse trade may not show up until early in the 2019 calendar year, so some patience will be required. The downside of the rising prices though, is that they could encourage Indian farmers to increase rabi planting, which starts in November.

All in all, these developments in the Indian market confirm that eventually, low prices will cure low prices. That transition would have been less painful except that the Indian government felt it needed to manipulate the market, causing the turmoil that’s been facing farmers and traders in 2018.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.