Pulse Market Insight #174 AUG 22 2018 | Producers | Pulse Market Insights

Trade Dispute Sideswipes the Lentil Trade

Currency exchange rates are always a factor in traders’ calculations but most times, the changes are fairly gradual and allow trade flows to adjust and adapt. In the past few weeks though, we’ve seen some large disruptions caused by trade disputes and other geopolitical events. Normally, we pay the most attention to the value of the Canadian dollar but this time, it’s a currency that’s a little more obscure.

Aside from seeing the odd headline about turmoil in the Turkish economy, most people probably haven’t noticed much about the recent political and trade dispute between the US and Turkey. But for lentil growers and marketers, the sharp drop in the value of the Turkish lira is an important development.

The lira has been losing ground against the US dollar fairly gradually over the past couple of years but since the beginning of August the value has plummeted as trade tensions with the US have ratcheted up. The graph showing the Turkish lira against the US dollar literally looks like the proverbial “hockey stick chart”. At the end of July, the exchange rate was less than 4.9 lira per US dollar but within two weeks, that spiked to nearly 6.9 lira, a 40% loss in value. The equivalent for Canada would be a drop from a US$0.77 exchange to a US$0.46 rate over the span of one month. The lira/greenback exchange rate has moderated a bit since then but is still nearly 6.1 lira per US dollar.

Lentil growers may wonder what that has to do with their business, but it’s a large impact. That’s especially the case since India isn’t buying any sizable volumes of red lentils lately, which left Turkey as the main destination. The problem is that with a much weaker currency, Turkish buyers are finding red lentils (and other pulses) a lot less affordable.

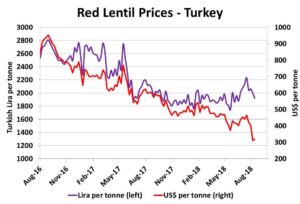

The chart shows red lentil prices in Turkey priced in lira and in US dollars. Lentil prices had been steady or even firmed up when measured in the local currency, as the lira started to weaken. But even that “bounce” wasn’t nearly enough to offset the currency swing. Converted to US dollars, the lentil price fell to US$320 per tonne, a drop of US$145 per tonne from the late July price.

Essentially, that means the value of red lentils traded into Turkey has dropped over 30% in less than a month, and that doesn’t pencil out for Canadian exporters. The result is a slowdown, if not a complete stop, in Turkish buying at current price levels in Canada and Australia. This is how a political dispute that doesn’t even involve Canada can spill over and affect our pulse markets.

Heading into 2018/19, we already knew lentil exports would be a challenge due to the Indian import tariffs. Based on that alone, we expected any recovery in trade and prices wouldn’t show up until early 2019, at the soonest. But we had been counting on decent exports of lentils to (and through) Turkey. Now even that is in doubt, which would push the market recovery further into the future.

The one ray of hope in this situation is that these kinds of disputes can be resolved fairly quickly, if level-headed thinking prevails, which would allow trade to resume. The danger is that the leaders of both of these countries have been known to make rash decisions, so the risk remains for now.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.