Pulse Market Insight #178 OCT 15 2018 | Producers | Pulse Market Insights

Fababeans on Fire

With all the negative news going on in pulse markets these days, it’s nice to report that there one or two bright spots as well. Last year, fababeans fell out of favour with some farmers as the market was soft and yields in some areas were disappointing. There were also some stops and starts in movement of fababeans, not unusual for a crop that’s still at a fairly early stage in market development.

This spring, acreage on the prairies dropped by a quarter, with the largest declines in Saskatchewan. Seeded area is reported at just under 80,000 acres, about half of the market peak in 2015. Fast forward a few months and the outlook on fababeans has definitely turned around.

There are a number of factors driving the turnaround. One of them is the harvest difficulties in western Canada which are threatening to reduce 2018 crop output even further. We’ve heard reports from several areas that the forest fire smoke from the west caused delays in crop maturity of up to a couple of weeks or more. This slow crop development then ran into the wet and snowy weather in September and early October. The problem now is whether those fababeans can be harvested and if so, what the quality will be. This concern has added more upside to the current price environment.

These issues with the Canadian crop however, aren’t nearly enough to cause the reaction we’ve seen in global markets. Just to review the global marketplace, the main export competitors are Australia, the UK, France and, in more recent years, Baltic countries. A quick survey of those countries’ crop production indicates that all of them faced drought in 2018, and most of them experienced serious yield losses.

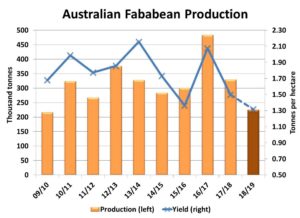

For example, the latest official estimates from Australia, the dominant exporter, show the lowest fababean yields in over 10 years, with production dropping by a third from last year. There are other suggestions that yields and production will end up significantly lower than that.

These shortfalls in all key exporters mean that buyers in Egypt, the main destination for fababeans, are looking for replacements from other sources, including Canada. Interest has picked up for both tannin and white fababeans.

Even back in August, Canadian fababean exports were already stronger than usual but it wasn’t just Egypt buying fababeans. The US was actually the largest customer in August and we expect most of those were being processed into other products.

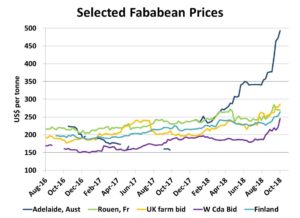

The combination of strong export demand and concerns about harvest outcomes has pushed Canadian fababean bids higher. There’s still a wide range of bids, depending on how badly various buyers need to cover sales, but some have now topped C$10.00 per bushel and the average (including tannin and white varieties) is C$8.50-9.00 per bushel.

These Canadian values however pale in comparison with other countries. Prices have been rising strongly in western Europe and it’s not just because of export demand. This year’s drought in northern Europe has driven feedgrain prices higher and that’s also lifted prices of fababeans as a feed ingredient.

The extreme situation is in Australia, where the severe drought has caused prices of most crops to spike, including fababeans. The record high prices there aren’t a reflection of the export market, but rather the domestic feed market where barley bids have jumped to A$8.00 per bushel or higher. This means Australia has priced itself out of the global market and will not be exporting any meaningful volumes.

This situation is good news for Canadian farmers who have been able to get their fababeans harvested but will be frustrating for those who are still trying to harvest the crop.

The last bit of information for Canadian farmers is that this strong market situation will certainly encourage more plantings in 2019, if seed can be found. That will be the case here in Canada but also in other countries, where high prices will encourage more plantings. If next year’s weather cooperates, chances are that prices will shift lower, which suggests forward-pricing the 2019 crop would be a good option.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.