Pulse Market Insight #180 NOV 9 2018 | Producers | Pulse Market Insights

Pea Exports Solid but Don’t Need to be Spectacular

There was a lot of hand wringing earlier this year about the loss of India as a buyer of peas. While that’s certainly had an impact on the market, other buyers are stepping up to fill the gap and that’s already providing support for prices, even though the harvest is barely over.

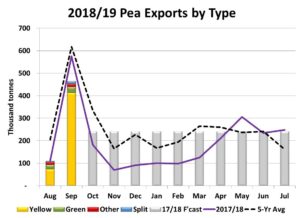

The usual pattern for Canadian pea exports is to spike higher in September and that’s been the case again in 2018/19, although the totals have been a little behind last year and the average pace. Even so, they’re not too bad considering the loss of Canada’s largest customer. In September, 465,000 tonnes of peas were exported compared to the average of a little over 600,000 tonnes.

Despite this slower start, our view is that exports for the rest of 2018/19 only need to perform at roughly the average level for the rest of the year in order to hit our full-year target of 3.0 million tonnes. Based on the signals we’re getting, an average pace seems to be quite doable. And if that’s the case, 2018/19 ending stocks will shrink from last year’s levels and will tend to support prices.

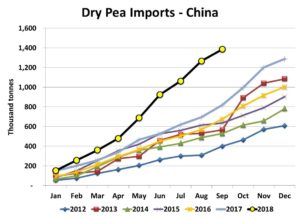

To a large extent, Chinese demand has been the main driver of these solid exports but, contrary to popular opinion, it’s not just a response to the US/China trade dispute over soybeans. The chart below shows Chinese pea imports over the last number of years. The first thing that jumps off the chart is that the 2018 import pace is far ahead of any previous year. As of September, 2018 imports are just shy of 1.4 million tonnes compared to the 2017 pace of 820,000 tonnes, with the large majority of these coming from Canada. At this rate, Chinese imports for the 2018 calendar year could hit 2.0 million tonnes and there’s no reason to think the pace will slow in 2019, as long as Canadian pea supplies are available.

The reason why we expect the strong demand will continue is that the pace of Chinese purchases actually started to turn higher already in the second half of 2017, well before China started talking about imposing tariffs on US soybeans. While the pace has picked up further in 2018, the larger purchases were showing up before the trade dispute got underway. This is important, as it suggests large Chinese pea purchases would continue even if the trade dispute over US soybeans is resolved in the coming months.

But China isn’t the whole story; Canada is also selling meaningful volumes of peas into the US. In 2017/18, Canadian exports to the US hit 355,000 tonnes, tripling the previous record and early in 2018/19, volumes are nearly keeping up with last year. And one final note: we just noted a small volume of peas moved out of Thunder Bay and we expect these were headed to Europe where this year’s drought has caused feed prices to climb to multiyear highs. If that continues, it’s one more outlet for Canadian peas in 2018/19.

One of the strongest clues of this healthy balance between supplies and export demand is the price behaviour over the past month or two. Typically, prices dip during harvest as farmer selling ramps up but this year, the “harvest weakness” was minimal. This suggests there was solid export buying but that farmers were also disciplined sellers. Since then, we’ve seen bids for both yellow and green peas edge higher even though there’s plenty of peas on-farm. This wouldn’t be happening unless there are ongoing export sales being made that need to be filled.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.