Pulse Market Insight #181 NOV 23 2018 | Producers | Pulse Market Insights

What’s the Latest in India?

The impact of Indian trade restrictions has faded in the pea market thanks to much stronger demand from China. Even so, the market situation there is still dominating the outlook for lentils and chickpeas. On the surface, there’s still nothing really happening on the India trade front, but our attention is starting to shift away from tariffs and other import restrictions to developments with Indian crops.

As a brief refresher, India has two main growing seasons, the kharif or summer crop and the rabi or winter crop. The kharif season is when most of the rain falls in the country and that’s just wrapping up now. There aren’t any official production estimates since the harvest began, but anecdotal reports are suggesting yields are down due to dry conditions late in the season. Pulses grown in the kharif season aren’t directly related to Canadian crops, but they do affect overall availability of pulses in the country.

The rabi planting season, which includes chickpeas, peas and lentils, is underway now and we’re watching carefully for early clues about crop potential. It’s worth noting that the rabi season is normally much drier and crops rely heavily on soil moisture reserves from the kharif season. This year, rainfall was well below average in the later stages of the kharif season, leaving moisture reserves low for rabi crops.

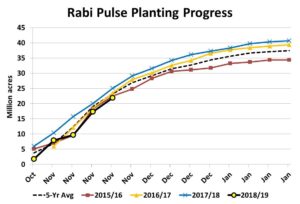

What we’ve seen so far is that planting of rabi pulses has been trailing the average pace and is well behind last year’s levels. The Indian government boosted its Minimum Support Prices for a number of pulses but that hasn’t been able to convince farmers to increase acreage. Largely, that’s because Indian farmers are skeptical as the government hasn’t been accepting all of the pulses that Indian farmers have been trying to sell at the MSPs.

The other reason for the slower planting pace is simply the dry conditions that have discouraged acreage. That situation could still change, although we remind readers that the rabi season typically only gets a small fraction of the rain that falls in the kharif season. This means it’s much harder to overcome a moisture deficit during the rabi season than in the kharif season.

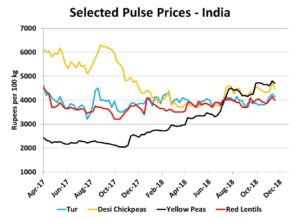

The potential for reduced acreage along with yield threats due to dry conditions already have the Indian market on edge. Prices for most kharif and rabi pulses turned a bit higher when these crop concerns were first expressed but that bounce has already faded again. Even so, it won’t take a lot for these prices to react again.

The big question of course is how this could affect Indian import restrictions. Our view is that nothing will happen quickly. Part of the reason is that India is still sitting on some fairly sizable stockpiles of chickpeas and lentils and would rely on those supplies over the short to medium term.

The political answer is that the situation won’t change until at least after the next Indian election, scheduled for April/May. The current government has tried to build its support based on backing farmers (roughly 40% of the population) with incentives such as the import restrictions. It would be “political suicide” for the government to drop its various price-supporting schemes before the election.

The bottom line is that the Indian crop situation has the potential to reduce domestic production, but it’s still very early to draw any firm conclusions. Even if that were to happen, the Indian government will stall on making any changes to its import regime. That will limit the opportunity for Canadian pulse exporters until later in 2018/19.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.