Pulse Market Insight #183 JAN 4 2019 | Producers | Pulse Market Insights

Acreage Guesses for 2019

So far this year, it seems new-crop bids for pulses are slower than usual coming out. This really shouldn’t be a surprise, given the ongoing uncertainty about India, still the pivotal factor for the pea and lentil outlooks. Other buyers are also important, but it’s generally Indian interest (or lack thereof) that sets the tone for next year’s prices.

Will poor crop outcomes in India force it to drop its import barriers? Will China continue to buy peas at a record pace? Will crop failures or bumper crops in other countries increase or reduce demand for Canadian pulses? None of these questions are easy to answer.

When Indian pulse demand was at its strongest a couple of years ago, buyers were already booking cargoes nearly a year ahead for a large harvest shipping program. Because of that, the first new-crop bids for the next crop started to show up in October. In reality though, these early-bird bids only occurred for 2-3 years at the peak of the Indian market. More typically, the majority of the bids haven’t shown up until January and that appears to be the case this year.

The lack of clear price signals makes it more difficult for farmers to nail down their 2019 acreage decisions. That said, we have a few educated guesses about where new-crop pricing will start to show up and we’ve made some tentative forecasts for seeded area in the coming year.

Even though current pulse prices aren’t spectacular, it feels like there’s a little more optimism for the 2019/20 marketing year than a year ago. Old-crop bids have been starting to edge higher, raising hopes for the next crop year and this should encourage more acres.

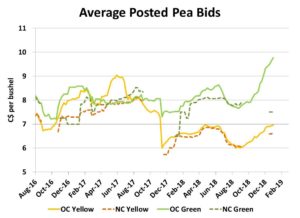

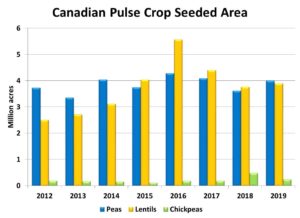

For peas, we’re expecting a partial recovery in 2019 plantings with a forecast of 4.0 million acres, 11% more than last year. Strong demand from China and hopes that India will reopen its borders are keeping the market supported. Prices still aren’t back up to the 2016 peak but aren’t far from the high points of the past few years. In particular, green pea bids have been very strong lately due to tighter supplies and a partial shift back toward greens is likely. Even with this acreage increase (and average yields), next year’s balance sheet for peas doesn’t look heavy. In fact, the market could probably handle an even larger acreage base next year without much trouble.

The lentil market has also come off the harvest lows and the modest bit of strength suggests seeded area will also be up in 2019. It also helps that farmers in lentil growing regions are looking for alternatives to durum which has been an underperformer. Our lentil estimate is 3.9 million acres, 3-4% more than a year ago. Together with a recovery to average yields, this would mean a solid increase in the 2019 crop, but production would still be well below the highs of the previous few years. Even if export demand remains flat, we think the lentil market should be able to handle this size of an acreage increase without too much difficulty.

The boom in kabuli chickpea prices is now in the rearview mirror and that will certainly trigger a decline in seeded area. Our first guesstimate is for seeded area to drop roughly in half from last year’s high, although at 225,000 acres, it’s still not a small acreage base by historical standards. Demand for chickpeas, particularly in North America, has been increasing in recent years and it appears the market can absorb another decent sized chickpea crop in 2019/20.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.