Pulse Market Insight #135 FEB 1 2019 | Producers | Pulse Market Insights

Pea Market Outlook

It’s that time of year when marketing decisions have two large components. Half the 2018/19 marketing year is still ahead and most people have a fair amount of old-crop pricing left to do. At the same time, seeding plans for 2019 need to get locked in and decisions need to be made about forward-contracting the next crop.

Let’s start with marketing plans for the rest of the 2018 pea crop. To most farmers, the only question that matters is whether prices will go higher or not. If we could answer that, the decision would be easy. It may sound funny coming from a market analyst, but the problem is that it’s impossible to predict the future with 100% confidence. And if the past couple of years of pulse markets have taught us any lessons, it’s that we can’t assume the status quo will continue.

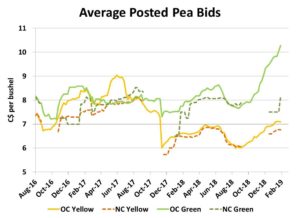

That said, there are some market signals are pointing us in a certain direction. The trend in pea prices has generally been stronger, although that’s much more the case for green peas than yellows. The rapid gain in green pea prices is a clear indication that supplies simply aren’t large enough to meet export demand, with or without India as a buyer. And with Canada and the US being the two major exporters of green peas, that shortfall isn’t going to be fixed until the 2019 harvest.

Those waiting to sell green peas “at the highs” are cautioned that prices will already start to move lower prior to harvest, as soon as buyers have sufficient coverage to tide them over until fresh supplies arrive. It’s also worth noting that it’s only after the fact that we know when the highs have occurred.

The yellow pea outlook is harder to forecast. Prices have moved up from last fall’s lows but have levelled off more recently. Exceptional demand from China has allowed yellow pea bids to move higher but for the time being, that’s gone a little quieter again. And with the diplomatic tensions in the air between Canada and China, a quick change in policy could have a large negative effect. In 2018/19, China has largely replaced India as the dominant pea buyer and, as pulse marketers have found out in the last couple of years, depending too heavily on one customer is risky.

On the flipside, there’s still the potential that India could come back as a buyer late in 2018/19 and scoop up more peas. While we’re optimistic that this could happen, it’s still far from a sure thing and the hoped-for pop in prices may or may not materialize. The bottom line is that, unlike green peas, the yellow pea outlook for the rest of 2018/19 is still a lot more uncertain and leaving too many eggs in an unsold basket carries considerable risk.

This uncertainty carries over into the new-crop outlook. There’s always the normal question about the seeded acreage in Canada and other major exporters. For the most part though, it doesn’t appear that there will be a big acreage response in Canada or elsewhere. In fact, some are expecting that seeded area of peas will decline. If that’s the case, it suggests next year’s supplies could end up relatively tight, although yields usually have an even larger influence on supplies.

The demand side of next year’s outlook is much less predictable. Trade disputes could still linger on well into 2019/20, and that could include both China and India.

Over the past number of years, Chinese demand has been growing at 200-300,000 tonnes per year and even if volumes dip a little next year from the record pace of 2018, it should still mean large volumes, as long as trade tensions don’t escalate.

We are also looking for India to return as a buyer in 2019/20, although the volumes won’t match the heydays of 2015/16 and 2016/17. Even so, the combination of modest Indian buying and solid Chinese purchases should keep the market supported.

This greater uncertainty for Canada’s two major pea buyers is why there are relatively few new-crop pea bids, even at this stage of the year. The few bids out there (shown in the chart) are stronger for greens, not really a surprise, and locking them in would be profitable. New-crop yellow pea bids aren’t showing quite that same strength but some may choose to reduce risk with a small amount of forward contracting.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.