Pulse Market Insight #139 MAR 31 2019 | Producers | Pulse Market Insights

How Will “China Syndrome” Affect Pulse Markets?

First, the good news. The diplomatic and trade tensions between Canada and China will have no impact on lentil, chickpea or dry bean markets. China simply doesn’t purchase those pulses in any quantity that would be able to influence those markets.

When it comes to peas however, the market has been affected by the friction between the two countries, but this didn’t just crop up in the last week or two. There aren’t any official pronouncements from the Chinese government restricting pea imports, but we’ve been hearing about delays in processing imports. It seems there’s considerable nervousness from both Canadian exporters and Chinese importers which has caused a slowdown in fresh sales.

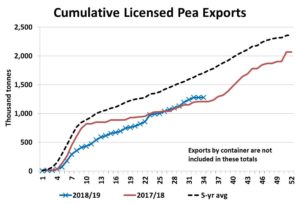

Canadian exports had been performing quite well through the normally slow middle portion of the marketing year, with a good portion of that headed to China. More recently though, we’re just seeing indications that fewer peas are moving to export terminals and the export pace has now taken a breather.

That’s not to say exports will come to a screeching halt. Smaller amounts of peas will still keep moving to China and there are other destinations available. But the strong pace is certainly moderating and the limited movement is causing buyers to soften their bids. Simply put, farmers would like to keep selling their peas but exporters simply don’t need to buy at the same pace as earlier.

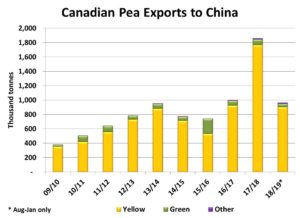

In reality though, only the yellow portion of the pea market that has been affected and green pea prices remain historically high. China imports only limited amounts of greens, especially when green pea prices are holding a premium over yellows. In 2017/18, when India backed out of the market, China stepped in and bought 1.77 mln tonnes of yellow peas, 75% of Canada’s yellow pea exports. Through the first half of 2018/19, the pace of Chinese purchases and its market share have been roughly similar to last year.

Unfortunately, even though we can speculate (fancy word for guess) at possible outcomes to the situation, there’s simply no way to forecast the future with respect to Chinese trade. In the short-term, China may have enough pea supplies to last a month or two but will have difficulty finding other supplies of peas to keep their fractionation plants running. Alterations could be made to use other sources of protein and starch but those will take some time.

Any type of export slowdown will keep pressure on Canadian bids and will cause a buildup in 2018/19 ending stocks, which then get carried forward into the next marketing year. Again, this outlook is mainly for yellow peas and not so much for greens.

If the situation drags out over the long haul, China could put phytosanitary agreements in place with Black Sea countries and increase pea purchases from there. But by then, it’s also possible India will have returned as a larger buyer of peas, reducing Canada’s dependence on China.

Ultimately though, this experience with China (and India) is another example of the risk that occurs from relying too heavily on a single customer. We know efforts are already being made to diversify export markets and also expand domestic processing. This latest snafu simply makes that more urgent.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.