Pulse Market Insight #140 APR 26 2019 | Producers | Pulse Market Insights

Will 2019 Acreage Shifts Influence Pulse Markets?

Every year, there’s plenty of uncertainty about seeded area with analysts and traders making their guesses about farmers’ decision-making. This year, the disruptions in canola trade with China added an extra layer of indecision to the acreage outlook. Many farmers said they would be sticking with their rotations, while others looked at making a few substitutions. This week, StatsCan issued the results of its seeding intentions survey and we got a few answers. If there is a theme for 2019, it’s that oilseeds are down while most cereal grain acreage is up.

For the most part, it looks like there weren’t too many impacts on pulse acreage. In part, that’s because land prepped for canola isn’t usually suitable for planting pulses. Farmers’ decisions concerning pulses were already made before the China canola kerfuffle began.

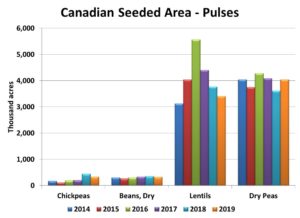

Seeded area of peas is estimated at 4.04 mln acres. That’s up almost 12% from last year and rivals the high end of Canadian pea acreage. It’s also a bit above the average trade guess, although a few were expecting even more pea acres. At a high level, this bounce in acreage has the potential to make supplies a little heavier but the actual yield outcomes will be the deciding factor. With an average yield, next year’s supplies will only be up 200-300,000 tonnes from 2018/19 and would mean a fairly well-balanced supply situation, allowing for a steady price outlook. But each bushel (higher or lower) makes a 100,000 tonne difference in the crop size.

For peas, the breakdown of greens versus yellows is also a key market factor. With old-crop green pea prices at $12.00 per bushel or higher and new-crop bids at $8.00-8.50, there’s plenty of incentive for farmers to bulk up on greens versus yellows. But we also know farmers will stick with growing yellow peas if the premium isn’t large enough. The fact that new-crop bids for greens are still in the $8 ballpark suggests that side of the market still hasn’t been swamped with extra acres. Unfortunately, this StatsCan report doesn’t provide these answers; we’ll have to wait for the June acreage estimates.

The 10% drop in lentil acreage reported by StatsCan is a welcome sign. Seeded area is forecast at 3.4 mln acres and is over two million acres off the high point in 2016. Overall, this acreage decline sets the stage for 2019/20 supplies to drop low enough to make the outlook tightish. And if (as we hope) India returns as a larger buyer, the outlook is even more optimistic.

But once again, yields will make all of the difference. Over the past few years, Canadian lentil yields have ranged from a low of 20.7 bu/acre up to 30.8 bu/acre and that has the potential to either make or break the market outlook. And just like peas, the breakdown between red and green lentils also plays a major factor. Based on the small spread between reds and greens, we would expect farmers to shift acreage toward reds as the lower risk option. Fortunately, that side of the market has the most potential to strengthen.

StatsCan is showing a 25% decline in seeded area of chickpeas for 2019. That’s off the multiyear high in 2018 which has caused burdensome supplies. This decline still leaves 2019 acreage at the second highest level since 2007 and this crop (using average yields), together with the large old-crop carryover, will keep the supply situation heavy. Fortunately, chickpea production in most other countries is down even more sharply, which could open more doors in export markets. Still, the large supplies in Canada (and the US) will limit upside in chickpea prices.

Dry bean acreage is forecast to decline by 8%, coming after a high point in 2018. StatsCan is estimating seeded area at 325,000 acres which would be low enough to cause supplies to tighten up and give prices some support. For the most part though, the flat dry bean acreage in the US will moderate the effect of a smaller Canadian crop. Plus, the StatsCan acreage estimates can differ significantly from what provincial crop insurance records say, so the story isn’t quite settled yet.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.