Pulse Market Insight #142 MAY 24 2019 | Producers | Pulse Market Insights

Is There any Good News from India?

Now that the Indian election is over, there are lots of questions (and high hopes) about the future of import tariffs and other trade restrictions in that country. The election results were decisive for the ruling party (BJP) of Narendra Modi, which returned to power with a strong majority. This was the party that instituted the import tariffs and quantitative import restrictions in the first place to shield Indian farmers from low pulse prices.

Pulse exporters had hoped that after the Indian election, there would be less need to appease farmers and the import barriers would be reduced or dropped entirely. While there’s no way of reliably predicting how the government will respond, our view is that weather conditions and crop outcomes will be the main deciding factors for the outlook for India’s pulse imports.

The rabi (winter) season accounts for nearly two-thirds of India’s pulse production and it’s also the season when lentils, peas and chickpeas are grown. The rabi harvest finished up a few weeks ago and the official government estimates for 2018/19 showed only a 5% decline from the previous year’s crop. All other analysts however feel that the crop total is significantly lower than the government’s optimistic forecast.

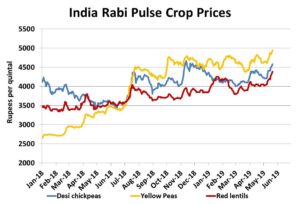

While pulse prices in India are distorted by the import barriers, the direction still helps indicate whether pulse supplies are adequate or not. For the most part, Indian pulse prices have been running sideways since the fall of 2018 as supplies have been comfortable. Since early May though, there’s been a bit more strength. For example, red lentil prices have moved up to the highest point since April 2017 and desi chickpeas are moving back up to challenge the late 2018 highs. For yellow peas, the combination of import restrictions and shrinking domestic supplies has pushed prices up to record levels.

For red lentils, these prices are now high enough to allow imports, even with the 33% import tariff. Some Canadian lentils have been flowing to India and that will continue. Even so, the existence of the tariff is a limiting factor for prices in Canada and lowering it would increase trade volumes and raise prices here.

For yellow peas, the situation is different with the Indian government having “hard” limits on import volumes as well as a 50% import tariff. This means the high prices won’t encourage allow pea imports to resume in a big way, unless the government raises the import quotas on pea imports.

The fact that pulse prices are rising at the same time as the election is over is coincidence, but the price increases could allow the Indian government to soften its import restrictions. After all, it also needs to satisfy pulse consumers in the country by keeping prices from rising too far.

The other large piece in the outlook is the upcoming kharif planting season. There are already worries about inadequate moisture and lower production. If that’s the case (and weather outcomes are never certain), prices of all pulses would rise even further in the country, forcing the government to reduce barriers even further.

Our view is that the Indian government will gradually relax import restrictions, starting with a higher quota for pea imports. Then, if pulse prices still remain high, import tariffs will start to be trimmed. That said, we don’t expect this to happen quickly or all at once but will be more of a wait-and-see approach by the Indian government. Still, it suggests Indian demand for Canadian pulses will improve at some point in 2019/20.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.