Pulse Market Insight #144 JUN 24 2019 | Producers | Pulse Market Insights

What’s the Outlook for Peas?

Usually as the crop season progresses, market outlooks get clearer and more straightforward. That certainly isn’t the case in 2019. Production outcomes actually seem to be getting less clear as the summer progresses and the trade challenges are just as cloudy as ever.

It was just a little over a week ago that we were gearing up for a serious crop disaster and were already adjusting our S&D’s to deal with much lower production. Since then, wide areas of the prairies have received meaningful rainfall amounts, throwing the crop forecasts back into question. There are still dry areas where the crop is threatened and the rain may have come too late for some of the crops.

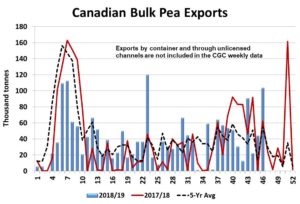

But before we look ahead too far into next year, it’s worth reviewing how 2018/19 is turning out. Contrary to earlier concerns that Canadian pea exports would dry up, volumes continue to be strong late in the season, with weekly volumes regularly above average levels. In fact, bulk exports reached 104,000 tonnes in shipping week 46 (middle of June), the highest total since early January.

There are no guarantees these strong exports will continue, but once container exports are added to the total, it’s clear 2018/19 exports will end up close to 3.0 million tonnes. If that’s the case, it has the potential to take ending stocks down below 400,000 tonnes, which certainly isn’t heavy.

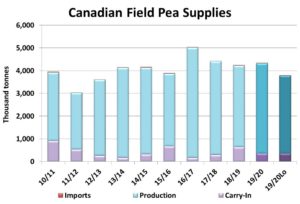

The lower carryover from 2018/19 also means there’s less cushion for 2019/20 supplies, which makes the production outlook a whole lot more important. We haven’t seen crop ratings yet for Alberta but in Saskatchewan, the latest crop report (as of June 17) put only 27% of the province’s peas in the good/excellent category. That’s actually a sharp drop from the 49% good/exc rating at the beginning of June, but it also wouldn’t have captured the impact of last weekend’s rain on the crop.

The severity of the damage early in the season suggests that even though this rain will give the crop a boost, it’s too late for yields to get back above average. Even if the 5-year average yield of 36.9 bu/acre is doable, pea supplies in 2019/20 still won’t be any larger than the current year, due to the smaller old-crop carryover.

Keep in mind that each drop of a bushel in the 2019 yield means the crop would shrink by 100,000 tonnes, so it won’t take much of a loss to actually make next year’s supplies tight. If the pea yield of 31.9 bu/acre in 2015 (which also had a drought followed by heavy rain in late June) is any indication, the 2019 crop would drop to 3.4 mln tonnes and supplies would be 3.8 mln tonnes, the lowest since 2012/13. In the end though, the reality will likely be somewhere between those two points and both of them are “friendly” for the 2019/20 price outlook.

From the demand perspective, there are still some unknowns but so far, it doesn’t look like Chinese demand is going to disappear completely, although it could be a little softer than in 2018/19. At the same time, more demand is expected to come from the US. Canadian domestic use will also start to move higher as some of the processing plants move into production phase. India is still a bit of a wildcard, but with poor monsoon rains, the odds of increased pea (and other pulse) imports are rising.

The bottom line is that the worst case scenario is a steady price outlook but there is some upside potential from either lower Canadian production or higher Indian demand. And the fact that farmers have done very little forward contracting and overseas buyers have done very little purchasing could add a little more excitement to the new-crop outlook.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.