Pulse Market Insight #149 SEP 13 2019 | Producers | Pulse Market Insights

How Will Delays Affect Pulse Markets?

It looks like 2019 is going to remind analysts who think they have the market all figured out that the weather has the final word about the outlook, even this late in the season. We’ve been tracking all the acreage and yield estimates and coming up with our best projections, but the ugly weather has thrown all of that into doubt. Of course, for farmers, the consequences are far more serious. In this article, we’ll look at how the markets will likely change because of the harvest disruptions.

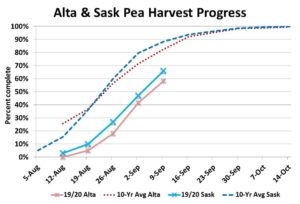

Pulses are usually the earliest harvested crops in western Canada but even they’re struggling this year to keep up the pace. In Saskatchewan, this week’s crop report showed 66% of the 2019 pea crop had been harvested, far behind last year at 94% and the 10-year average of 88% complete. In fact, 2019 progress is even running 10% slower than the dismal pea harvest of 2014/15. For Alberta, the situation isn’t any better, with only 58% harvested as of September 10, compared to last year at 80% and the 10-year average of 83% complete.

For lentils, only 63% of the Saskatchewan crop had been harvested as of early this week compared to 96% last year and the 10-year average of 78%. That’s a little better than the 2014 experience when only 47% was harvested, but it’s still looking ugly. The lentil harvest in Alberta is further advanced at 82% complete as of September 10.

These serious delays have already caused downgrades and lowered values. The damage is worse for pulse types such as green peas and green lentils that rely more heavily on the visual appearance. Even so, staining, dirt tag and wrinkling are affecting all types of pulses. In the slower harvest years of 2014 and 2016, 15-20% of the crop ended up as an X3 or lower grade. Based on StatsCan’s production estimate, this would mean roughly 700,000 tonnes of lower quality peas need to find a home. Quality downgrades for lentils similar to 2014 and 2016 would mean that over half of the crop would be X3 or lower, as much as 1.35 mln tonnes.

The big question is how this sudden change in the quality will affect the market. For one thing, overseas buyers will need to pay more attention to locking in supplies of the better quality pulses. Until now, export sales of peas and lentils have been quite slow as buyers have assumed there would be plenty of product for them whenever they needed it. While the total size of the crop hasn’t changed much (yet) because of the delays, they may need to start booking now to get the quality they want.

While buyers may try to stock up on pulses, the harvest delays mean farmers will likely become more reluctant sellers. Because of the weaker prices this summer, not a whole lot of pulses have been forward contracted and now, farmers are even more hesitant to price anything that isn’t in the bin yet or is of questionable quality.

The combination of more motivated buyers and less willing sellers should have the effect of firming prices up, although that may only apply to 1Can and 2Can pulses. We were already expecting that prices would start to follow the seasonal patterns higher but this may give the prices of the higher quality peas and lentils a bit more of a boost.

The flipside is that discounts for lower grades will likely widen out. This means bids for lower qualities may stay flat or even turn lower in the coming weeks and months. But if supplies of the higher quality peas and lentils start to run low later in the season, some of those grade specifications could become a little less stringent in order to fill in the gap.

The final, more positive impact is that the weaker prices associated with lower quality could help to clear the market of the large supplies that have been part of the pulse picture for the last couple of years. Price-sensitive buyers for food or feed may use this opportunity to buy more pulses, taking them off the market, reducing total supplies and providing some longer term price support.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.