Pulse Market Insight #150 SEP 30 2019 | Producers | Pulse Market Insights

Bigger Pea Crops are Concerning

Based on the mediocre prices for peas (particularly yellows) going into the planting season, I was surprised that Canadian farmers boosted acreage by 20% this spring. It’s true that part of this was fuelled by a 35% increase in green pea area because of multiyear high prices, but yellow pea acreage also expanded by 17%. I can only imagine what would have happened if yellows had been at $8.00 or more this spring.

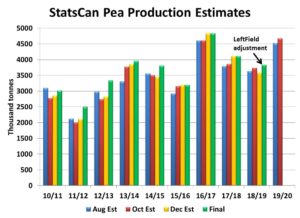

On top of the acreage boost, StatsCan yield estimates have pointed to above-average results in Alberta and Saskatchewan. That has the potential to boost the 2019/20 crop to 4.67 mln tonnes, a full million or 31% more than last year. On the surface, that big crop increase is raising concerns about possible oversupplies.

That said, there are still a couple of possible glitches in the pea yield outlook. For one thing, 22% of Alberta peas and 11% of Saskatchewan peas were still in the field with only a week left in September and the weather forecasts are discouraging. Secondly, we’ve been getting a number of reports that pea yields in central and northern Alberta are turning out far lower than earlier expectations. As a result, there’s a good chance that actual output will be lower (possibly a lot) than the estimates released earlier, when conditions looked a lot more positive.

It’s not just Canada where 2019 pea production is expected to be larger; in the US, seeded area also expanded by 28% from last year. The USDA is projecting a near-record yield which would bump up US production to over a million tonnes, 40% more than last year. The US has been a solid buyer of Canadian peas in the past and this could not only soften some of their demand but also keep them as a sizable competitor.

One brighter spot (from a Canadian perspective) is that Black Sea pea crops are expected to be down in 2019. Seeded area didn’t expand there and yields were hurt by hot dry conditions. This will limit Russian and Ukrainian competition in export markets.

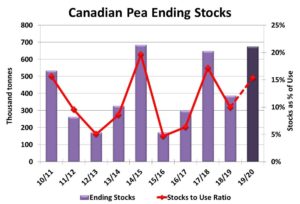

The problem with the larger Canadian crop is what to do with more than 5.0 mln tonnes (2019 production plus old-crop carryover) of peas. Some small gains are expected in domestic processing, but most of those increases aren’t scheduled to kick in until 2020/21. The downgraded 2019 crop could allow more feed use, but that doesn’t typically vary much from year to year. This leaves export demand as the main outlet.

Despite all the doom and gloom, we still think there’s room for exports to expand in 2019/20. Prospects for relaxation of Indian import barriers are fading, but our outlook doesn’t really count on much of an increase in Indian demand. Many have said that China will stop buying Canadian peas, but that hasn’t been the case so far. Even for China, we’re forecasting lower volumes in 2019/20 as the “bonus” feed pea purchases of last year won’t likely happen again. What we’re really expecting is that purchases from a number of smaller markets will pick up, especially with more affordable yellow peas, and that should be enough to allow a modest increase in 2019/20 pea exports.

Even with that improvement, the bigger crop will still cause a sizable increase in 2019/20 ending stocks, back up to the old highs. We emphasize though, that this will only occur if the entire 2019 crop gets harvested and the StatsCan yield estimate is close to reality. If not, ending stocks won’t be nearly as heavy as shown in the chart. On the flipside, a deteriorating export outcome means ending stocks could be looking at a new record. In either case, this should encourage a more defensive pea marketing plan for 2019/20.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.