Pulse Market Insight #153 NOV 8 2019 | Producers | Pulse Market Insights

Early Export Performance Offers Optimism for Some Pulses

It’s only one quarter into the 2019/20 marketing year, but there are already some strong clues from early export performance that could carry through to the rest of the year. Typically (but not always), a large portion of the annual exports move out in the first 3-4 months and those volumes set the tone for the export and supply outlook. That was less apparent in 2018/19 when Indian purchases were scaled back by import barriers, but seems to be showing up again in 2019/20.

For those who care to know, our export data come from two different sources – StatsCan and the Canadian Grain Commission – but the totals don’t match up, particularly for special crops. The CGC produces more timely weekly data but it doesn’t include container shipments, which are a large chunk of pulse exports. Meanwhile, StatsCan releases export data monthly, which includes container shipments and a breakdown by type, but it’s delayed by a number of weeks.

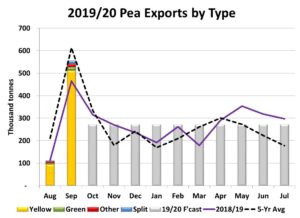

The StatsCan export numbers are only available for the first two months of 2019/20 and for peas, they show a very small amount in August followed by a much more positive total of 555,000 tonnes in September. It’s worth noting that this follows the seasonal tendencies fairly closely but is already outperforming last year’s exports, which ended up at nearly 3.3 mln tonnes.

This StatsCan data reveals a couple of other items. First, even though total volumes are well above last year, green pea exports so far are only 22,000 tonnes, less than half of last year’s pace. In part, that’s because there were virtually no old-crop supplies of green peas available for shipping in August while the harvest delays limited September shipments. Second, China dominates Canadian exports early in 2019/20 more than ever, accounting for 85% of total volume compared to 55% for all of last year.

From a seasonal perspective, exports in October are already dropping off and the CGC weekly data confirms that 2019/20 is following that pattern. Even so, decent export volumes are still showing up and the year-to-date total is 47% ahead of last year, although the pace is moderating as expected.

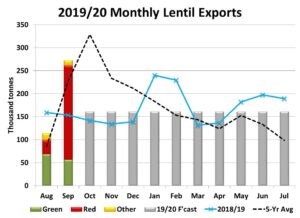

For lentils, it’s a similar picture. Volumes were low in August but jumped sharply in September to 273,000 tonnes, well ahead of last year and even the 5-year average total for the month. Year-to-date exports are actually the strongest since 2015/16, but it’s still early.

In the case of lentils, India has been the largest buyer early in 2019/20 for greens and the second largest for red lentils, in spite of import tariffs. One of the more positive developments for red lentils is that demand has been more dispersed early in 2019/20 and not so dependent on India. But as mentioned in the previous Pulse Market Insight, there is a risk of increased import barriers by India which could harm the export outlook.

Chickpea exports have been quieter to start 2019/20, even though there were plenty of old-crop supplies available, and that’s a potential concern. Of course, the quality of the 2019 harvest will be a dominant factor for exports in the rest of 2019/20.

Likewise for dry beans, volumes have been lower early in the marketing year but the demand side of the market will be the least concern for the export outlook. A very poor harvest in the eastern prairies will do far more to limit exports, while demand from Mexico will be considerably higher.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.