Pulse Market Insight #155 DEC 20 2019 | Producers | Pulse Market Insights

What to Watch for in Early 2020

This is the time of year when all sorts of people get nostalgic, looking back at the past year and making forecasts for the coming year. I’m not much of one for looking backward but there certainly are developments ahead that will have an impact on pulse markets. In fact, that’s one of the truisms about crop markets; there’s simply no such thing as a constant unchanging outlook.

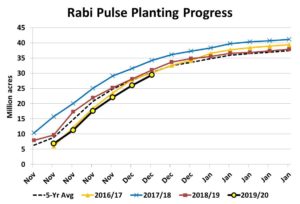

The biggest shifts to the outlooks come from weather events. At this time of year, most of the focus is on India. Even though India has faded a bit as a market driver, it is still very important to the outlook. At this stage in December, most of its winter (rabi) pulse crop, including peas, lentils and chickpeas, has normally been planted.

Earlier in the season, we heard concerns about excess moisture that would delay or reduce Indian pulse plantings but those fears seem to have been overblown. In fact, the higher soil moisture levels were probably more helpful than harmful once Indian farmers got the crop in the ground. Planting progress, which had been lagging earlier, has largely caught up to normal levels.

While it’s still only part way through the growing season, this improved outlook for Indian rabi pulses suggests there will be less incentive for the government to open the borders to imports. That’s not positive for Canadian prospects although lentils and some peas have been flowing into the country even with India’s import barriers. It’s just that additional demand from India would have had the potential to tighten up supplies significantly, so the status quo simply means a more muted pea and lentil market for the rest of 2019/20.

The other crop worth watching at this time of year is Mexico, particularly for kabuli chickpeas and dry beans. We already know that Mexican summer dry bean production was the lowest in many years and that’s causing prices there to rise. This occurred at the same time as the Canadian and US bean crops were also compromised, and that’s leading to the explosive price behaviour. Now, the winter bean crop is being planted in Mexico and the early indications are that conditions are looking a bit better than they did for the summer crop.

Looking a bit further ahead, the most crucial part of the pulse outlook is what Canadian farmers will do with their seeded acreage. There are certainly some brighter spots for prices, including green peas and most dry bean varieties. In addition, there’s some modest optimism as prices of red and green lentils and yellow peas are gradually edging their way higher.

As a result, we’re expecting 2020 seeded area to expand for most pulses, with the exception of chickpeas. And as we look even further ahead at potential demand in the next crop year, the market should be able to absorb an increase in Canadian production, if it isn’t too large.

Of course, the supply outlook isn’t just a function of acreage. Yields tend to be an even variable, making the picture highly dependent on weather developments. That part of the forecast is simply too far into the future to draw any meaningful conclusions, leaving some “mystery” in the outlook.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.