Pulse Market Insight #156 JAN 13 2020 | Producers | Pulse Market Insights

Dry Bean Market Comes Alive

Of all the crops affected by the ugly harvest weather in 2019, dry beans were probably hit the hardest. The extremely wet fall did a real number on the crop quality and the harvest was delayed long enough that many areas had to deal with snow on the unharvested crop.

The impacts were variable, with eastern Canada and Michigan faring better than out west. Manitoba and North Dakota were particularly hard hit, with one-third of the bean crop still in the field as of the end of October. Reports from various sources talked about lost quality and lower yields, and those likely aren’t fully reflected in the official statistics.

The “final” production report from StatsCan showed the Canadian 2019 dry bean crop at 317,000 tonnes, down 8% from last year, even though seeded area was higher by 12%. StatsCan doesn’t provide a complete breakdown by type but did indicate that white bean production was down harder (13%) while the coloured bean crop was lower by 7%.

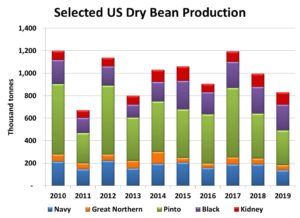

Of course, the US dry bean crop dominates the North American market and this week, the USDA released its production estimates. Even though seeded area was higher by 5% from last year, the 2019 dry bean crop of 944,000 tonnes was 17% smaller than a year ago. A few classes of beans, such as blacks, kidneys and limas, experienced only small declines or even a marginal increase in crop size. For other classes, including navies, pintos and cranberries, the decline was much larger.

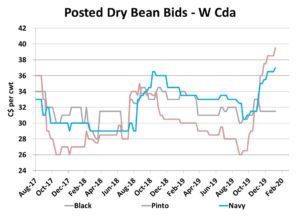

These poor crop outcomes have certainly had an impact on dry bean prices in 2019/20, although the price performance has been variable. Because the production losses were much larger for pintos and navy beans, those two classes have led the market higher. Meanwhile, black bean prices have been mostly flat. Other minor classes have seen variable price performance.

The other bullish factor in the dry bean market is the sharp drop in the Mexican summer bean crop, with even larger losses than those seen in Canada and the US. This will add to the demand on North American dry bean supplies which aren’t adequate to meet all of the market’s needs.

This strong bean market is already showing up in favourable new-crop dry bean bids. Even though values aren’t quite at spot price levels, they are quite attractive and should encourage more bean plantings again in 2020. Of course, this assumes seed supplies are large enough to meet the demand.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.