Pulse Market Insight #158 FEB 21 2020 | Producers | Pulse Market Insights

Farmers’ Planting Plans Have a Lot to Say

The title of this article might fall into the category of “blindingly obvious”. Of course, farmers’ acreage decisions are one of the main variables in any market outlook. Maybe a better way of putting it would be “how farmers’ seeding plans will affect pulse markets”. And even that’s only part of the picture; yields have a massive impact on supply levels. Again, no surprise to anyone.

There are lots of opinions from farmers and analysts about seeded acreage for 2020. In reality, that’s all they are. At best, they’re guesstimates. We also often hear that most farmers aren’t too willing to make large-scale changes to their crop rotations, as these decisions have lingering effects for the next several years, especially since disease and herbicide resistance issues are more important than ever.

As a result of some of this rotation inertia, we’re not expecting large shifts in most pulse acreage. We’ve also noticed that new-crop bids for most pulses have been extremely slow in coming out and haven’t been providing much direction for farmers. This leaves old-crop bids and analysts’ outlooks (and we know how reliable those forecasts are) as the main decision criteria.

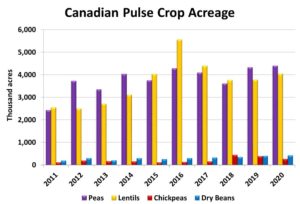

For peas, we’re guesstimating only a small 2% increase in seeded area at 4.4 mln acres. Of course, more of that seeded area would shift into greens as the few new-crop bids out there are in the $8.00 ballpark versus $6.00 (and change) for yellows. Generally, that’s enough of a premium to encourage a few more greens rather than yellows.

Even though this would be a new record for pea acreage, with average yields it wouldn’t actually result in large oversupplies. There will be fewer old-crop peas carried forward into next year which will help limit the supply growth. And as long as China continues buying Canadian peas at its current rate (never a 100% certainty), demand will be sufficient even if Indian purchases drop off. A little more domestic processing won’t hurt either.

Earlier, we had expected only a marginal increase in lentil seeded area, but now that there’s been a little more life in old-crop bids, we’re looking at a 7% increase in seeded area at just over 4.0 mln acres. With only a small spread between red and green lentil bids, we would expect seeded area to continue shifting toward reds in 2020.

Just like for peas though, this acreage increase for lentils isn’t going to overwhelm the market with supplies as long as yields are close to average. Export demand only needs to remain flat in order to keep next year’s ending stocks at reasonably low levels, and we think that’s quite doable.

The weaker prices for chickpeas will almost certainly cause seeded area to drop, but the size of the reduction is anybody’s guess. Our guess is a 30% drop to 275,000 acres. Unlike peas and lentils, which will have smaller carryover into 2020/21, supplies of chickpeas will still be quite large. Even this drop in seeded area won’t be enough to cause a meaningful cut to supplies next year.

In contrast to other pulses, both old-crop and new-crop bids for most dry bean types are at multiyear highs and that should serve to encourage more plantings. We’re forecasting 425,000 acres which would be an 8% increase from last year and would be the most since 2006. Some classes such as pintos and white beans are showing far more strength while blacks are lagging, meaning planted area will shift between the various bean types.

As we’ve tried to say in various ways, these are still just preliminary guesstimates but we think they capture some of the sentiment in the markets. As a (very) general guideline for marketing decisions, crops with large expected acreage increases such as dry beans should be forward-marketed more aggressively while more patience is advised for crops with declining acreage like chickpeas.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.