Pulse Market Insight #161 APR 17 2020 | Producers | Pulse Market Insights

What’s Driving Pulse Prices Higher Now?

Amid all the gloom and difficulties caused by the Covid-19 situation, pulses have stood above the commodities crowd. For those who haven’t heard yet, prices are up and demand is strong, providing a bright spot for western Canadian farmers.

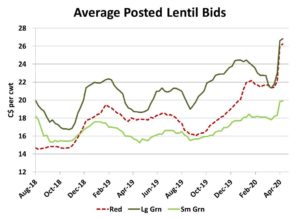

Truth be told, bids for a number of pulses in western Canada had already been edging higher throughout much of 2019/20, but the gains were gradual enough that they weren’t attracting any attention. Supplies of peas and lentils were gradually being drawn down and prospects were looking friendly, although very few people seemed to be noticing.

This lack of attention created a kind of complacency about supplies and prices, which kept the market from reflecting these fairly normal developments. As long as overseas buyers felt that Canadian supplies were plentiful, they didn’t need to worry about building coverage. And farmers who had accepted that no one wanted their pulses very badly were more willing to sell when bids ticked up a dime per bushel or a half cent per pound.

The predictable part of the story is that supplies had been gradually tightening, but no one forecasted the fuel that was added to the fire in the past few weeks, namely the Covid-19 pandemic and its effect on marketers’ mindsets.

Prices for the major pulse crops have jumped sharply, with lentils taking the lead and peas also moving strongly higher. Our price tracking shows average bids last week, but that’s not really keeping up with the speed of the rally. Old-crop bids for red and large green lentils have now touched on 30 cents per pound, yellow peas are now closer to $8.00 per bushel and green peas are back up to $12.00 per bushel.

Other pulses are seeing less reaction. So far, there still isn’t a real shortage of chickpeas, but there could be some light at the end of that tunnel too. Dry bean prices spiked earlier this year due to disastrous harvests in Canada and the US and now there are almost no beans left to buy, regardless of the price.

New-crop bids for lentils and peas have also turned higher. The complacency among buyers has not only been shaken in the short-term; there are increasing concerns about locking in supplies for the months ahead. Back in 2015/16 and 2016/17, overseas buyers were aggressively forward-buying pulses to nail down supplies and that same kind of mindset is now showing up again.

To boil it down to basics, pulse markets have started to react a bit like the recent panic over toilet paper shortages at grocery stores. Here in Canada, where an excess of food is grown, it’s hard to really grasp issues related to food security. But for some countries that import as much as 90% of their food needs, having access to supplies is an extremely serious concern.

Some may view this as simply a short-term panic-driven market situation. While there could be some truth in that, we think these kind of food security concerns are going to remain in the forefront for quite some time. As a result, pulse markets will likely remain well supported for at least a few months, if not longer.

The longer-term view will depend on how well Canadian farmers are able to meet this stronger demand. It’s late in the season to make changes to planting plans, but some will be responding to this latest price shift. From there, the weather in western Canada will determine the outcomes. While no one wants to take advantage of someone else’s misery, this presents a large opportunity to western Canadian farmers. It also clearly demonstrates how quickly markets can shift and how difficult it is to predict the future.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.