Pulse Market Insight #165 JUN 12 2020 | Producers | Pulse Market Insights

Lentil Trade Irritants Solved?

It’s an unfortunate reality that politics plays such a large role in trade, when economics and market conditions should be the main considerations. But even when trade decisions are entirely political, market realities usually exert their influence (eventually) and overrule the politics. But in the meantime, the impact of trade decisions is usually painful.

It appears that market realities are starting to intrude on the situation for Indian pulses, at least for lentils. Recently, the Indian government announced that import tariffs on lentils would be reduced temporarily from 33% to 11% (from 55% to 33% for US lentils). There weren’t any official reasons given by the Indian government, but we can make a few guesses about the situation there.

First of all, this tariff reduction is scheduled to expire August 31, which suggests it’s meant to address a short-term situation. India has enacted a rather strict shutdown in an attempt to slow the spread of the Covid-19 virus and that has disrupted domestic movement of farm products. This means it’s difficult to get the recently harvested lentil crop to markets in the largest population centres. For those cities on the coast, imported lentils may be the most direct supply route.

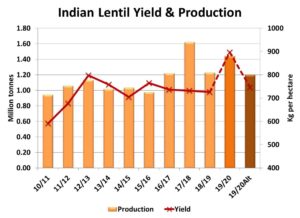

Another (and more likely) possibility is that the recent Indian lentil harvest wasn’t nearly as large as expected. The latest production estimate from the Indian government pegged the lentil crop at 1.44 mln tonnes, but that would have required a yield that topped any previous year by a wide margin. Based on regular reports from various sources, conditions certainly weren’t that positive. Other estimates have the crop at 1.20 mln tonnes, largely unchanged from last year, and even that may be a stretch.

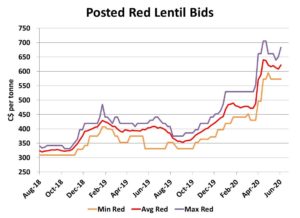

The response to this drop in the lentil tariff has been mixed. If more lentils are going to flow into India, it should cause prices there to drop. That has been the case for green lentils, which have noticeably declined but haven’t entirely crashed. Meanwhile, red lentil prices in India have shown almost no response and remain near the multiyear highs that have been in place since early April.

In western Canada, there has been some response in lentil prices but it too has been mixed. After slipping back from the panic-buying highs in late April, lentil bids have experienced another bounce, but not everywhere. Some buyers have moved bids back up sharply while others remain steady. This suggests that not everyone participated in the uptick in Indian business when the tariff dropped. The same type of response is seen for various sizes of green lentils, with some buyers raising their bids while others stay constant.

While this is a positive development, there are a number of questions that remain. First of all, will the lower tariffs actually expire at the end of August or will they be extended beyond. If this is a situation where India is really short of lentils and it’s not just a logistical disruption, chances are some sort of reduced tariffs will continue until its next lentil harvest in early 2021.

Even if the tariff goes back to 33% in September, this temporary reduction will still have provided support for the new-crop market. That’s because it has helped drain most of the old-crop lentils out of western Canada and the even smaller carryover will keep 2020/21 supplies on the tight side.

Another question we’ve heard is whether India will also drop some of the barriers for pea imports. This is where things are less positive. India has produced a large desi chickpea crop and those prices remain on the lows. As a result, yellow peas which are a substitute for desi chickpeas are unlikely to see any easing of restrictions.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.