Pulse Market Insight #167 JUL 10 2020 | Producers | Pulse Market Insights

How Will StatsCan’s Acreage Numbers Affect Pulse Markets?

Last week, the highly anticipated (by us) 2020 acreage estimates were released by StatsCan. These numbers are based on a survey of roughly 25,000 (somewhat annoyed) farmers and provide a good snapshot of this year’s acreage decisions. Yes, there’s always some room for error, especially among the smaller crops but it’s still superior to other guesswork out there and gives direction to all market participants, including farmers.

For pulses in general, the survey results were mostly not surprising although a couple of the numbers were a little “interesting”. This spring, many observers had expected the bump in pulse prices would boost acreage. That seemed to be the case for lentils and may have stabilized pea acreage.

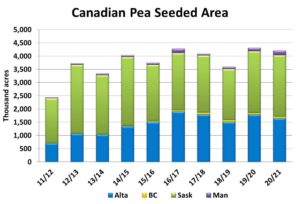

The estimate of 4.26 million acres of peas was nearly unchanged from StatsCan’s seeding intentions number, even though some had expected more of a drop due to disease and production issues last year. This seeded area is only 2% less than 2019, although it’s worth noting that the largest decline (8%) showed up in Alberta where last year’s yields were most disappointing. The most notable (but still small) increase was in Manitoba, where new fractionation plants have encouraged more acres.

A small drop in acreage would normally be a bit supportive for the price outlook but it’s likely even friendlier, given that the carryover from 2019/20 is expected to be smaller. This could leave 2020/21 supplies lower than the current marketing year. Of course, yields will have a lot to say about that outcome but as we learned last year, favourable conditions in early July don’t mean big yields in August.

When we look a little below the surface, another important distinction shows up. Seeded area of green peas is up 18% from last year, driven by strong prices in 2019/20 and profitable new-crop bids for 2020/21. This has the potential to weigh more heavily on that side of the market. Meanwhile, yellow pea acres were reported to be down 6% and that should add a little more price support for that portion of the crop.

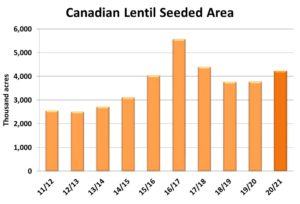

The StatsCan report confirmed what many people were thinking about lentil plantings, raising the total to 4.23 mln acres. That’s up 12% from last year and well above StatsCan’s surprisingly low seeding intentions number. Yields will be watched closely but based on an average outcome, this increase in plantings isn’t necessarily negative for prices. That’s because the lentil carryover from 2019/20 will be sharply lower and could more than offset a larger 2020 crop.

Just like peas, the outlook gets more interesting when looking at the individual classes of lentils. Essentially all of the increase is showing up in red lentils while green lentil acreage is actually down from last year. This makes sense, given that bids for large green and red lentils only differed by a couple of cents, thus encouraging planting of reds. If that’s the case, the price outlook is friendlier for greens than reds, but both are still positive.

Probably the largest surprise for pulses was the chickpea acreage number. Sure, seeded area was reported down 24% from last year but a much larger drop was expected because of lacklustre prices and slow movement. This estimate suggests a core group of chickpea growers have built chickpeas into their rotations and are prepared to store them. Even with this drop in plantings, the problem with the outlook is that heavy supplies of old-crop chickpeas are still hanging over the market. That’s going to make a price recovery more difficult and drawn out.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.