Pulse Market Insight #168 JUL 24 2020 | Producers | Pulse Market Insights

Differing Yield Outcomes Require Flexible Marketing

Every year, especially at this time, there are all kinds of opinions about crop yields. There’s a very good reason for that; western Canada is a big place and crop conditions always vary considerably. There’s a lot of ground between Beaverlodge to Beausejour, all with tremendous variability. Even within a few miles, crops can look very different depending on a thunderstorm hitting (or missing) at the right (or wrong) time.

That’s why it’s so hard to nail down yields. I enjoy seeing crop pictures on Twitter but they tend to be very selective (no one posts pictures of average looking crops) and hardly represent all of western Canada. Driving tours across the prairies can give a general impression of crops but are still limited.

Conditions can also change fairly quickly, either improving or deteriorating. That was the lesson learned last year when pea crops in central Alberta were looking fabulous, with very optimistic yield forecasts. In the end though, the moisture that caused the luxuriant growth ended up robbing yields when pods didn’t fill. It’s possible some of those same conditions might be showing up again in 2020.

All this is to say that final yield outcomes can look a lot different than current forecasts, both better or worse. And as always, the impact of yields on markets can be huge. Normally, our early-season outlooks use the 5-year average yield until there’s a good reason to adjust it up or down, typically at this time of year.

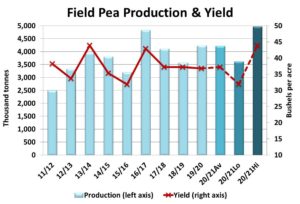

The 5-year average pea yield for the prairies is 37.2 bu/acre but over the past 10 years, results have ranged from a low of 31.9 bushels (in 2015) to a high of 43.9 bu/acre (in 2013). Based on StatsCan’s 2020 acreage numbers, the average yield would mean a crop of 4.2 mln tonnes. The lowest yield in the last 10 years would result in a crop of only 3.6 mln tonnes while the top end would mean nearly 5.0 mln tonnes of peas.

This potential range of 1.4 mln tonnes would have huge implications for the 2020/21 marketing year, from a crop at multiyear lows to a record high. In reality though, the actual outcome will be somewhere between those two extremes.

When we use the 5-year average yield for a crop of 4.2 mln tonnes, our 2020/21 pea S&D looks fairly snug, especially since the carryover from 2019/20 is quite low. Exports would be restricted by limited supplies, which would tend to give prices a lift. In this case, a marketing strategy should be more patient, allowing prices to recover after the normal harvest pressure.

An outlook based on a low yield outcome would be strongly bullish as supplies would be much too low to meet even normal export demand. But based on numerous reports from the country, this type of scenario isn’t on the table in 2020.

We’ve been hearing some very optimistic projections lately, with some suggesting yields well above average. If that’s the case, 2020/21 supplies could outstrip normal demand, even with the extra domestic processing expected to come on stream later in 2020/21. Under these conditions, prices would remain under pressure for an extended period. Marketing would need to be more defensive and would involve selling a little more aggressively, whenever an opportunity to take a profit shows up. Either that or holding onto the crop for much longer.

Because of the uncertainty, we’re hesitant to predict an exact yield at this stage. On balance though, it’s looking quite positive for the 2020 crop and we’re leaning toward above-average yields. Crops in parts of Alberta are clearly suffering but will likely be more than offset by good conditions in other parts of the prairies. Currently, the market is going through its seasonal lows and it’s a time to avoid making sales regardless, but price expectations for the post-harvest period might need to be tempered.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.