Pulse Market Insight #169 AUG 28 2020 | Producers | Pulse Market Insights

Does India Still Influence Pulse Markets?

The conventional wisdom used to be that direction in pulse markets depended almost entirely on the situation in India. The standard line was that “India is the world’s largest producer, consumer and importer of pulses”. While the first two items still apply, the third isn’t necessarily true, especially for some pulse crops.

Ever since India decided to apply import tariffs on pulses back in late 2017, it’s had a much smaller role in global pulse trade. That’s especially the case for peas where high import tariffs and tight restrictions on import amounts have both been imposed. Import barriers for lentils haven’t been as severe but have still had a significant impact. Other pulses not grown by Canadian farmers have also been affected.

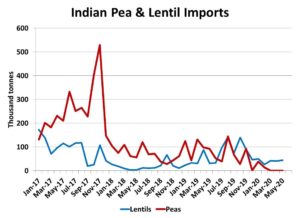

The impact on import volumes has been considerable, with peas seeing the biggest effect. Prior to the restrictions, monthly totals regularly topped 200,000 tonnes. Since then, pea imports have dropped off with some small amounts still able to bypass the restrictions. In the past few months, those amounts have dropped to zero. That said, there have been reports of peas coming into India from neighbouring countries through “unofficial channels”.

This slowdown in Indian imports certainly weighed on Canadian pea markets but farmers here were spared the worst case scenario, as China stepped up to replace Indian demand. Still, two major buyers would have made pea prices a lot more “buoyant” than they have been the last couple of years.

For lentils, the change has been less noticeable as volumes have continued to flow, even with a 30% import tariff. The main difference is that this import tariff reduced the price that Canadian farmers would have otherwise received. In 2019/20, Turkey boosted its lentil imports which helped offset some weaker Indian demand.

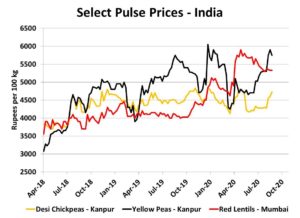

This lower Indian demand for imported pulses has had a depressing effect on Canadian markets, but there are signs that economic realities in India are forcing a change. If the Indian government’s goal was to restrict pulse imports and shrink supplies, it seems to have worked. Now, with pulse prices in India climbing and consumers grumbling, there are some cracks showing in the import barriers.

First of all, India temporarily reduced its import tariff on lentils from 30% to 10%, at least until the end of August. That deadline triggered a rush of lentil trade, with heavy Canadian shipments over the past three months (not showing up yet in the import chart above). This flurry of buying briefly boosted lentil bids in western Canada to 30 cents per pound or beyond.

With an August 31 deadline on the 10% tariff, the Indian government should make an announcement in the next few days and we wouldn’t be surprised to see them extend the lower tariff for another few months. The reason is that, in spite of large volumes of imported lentils, prices in India are still remaining firm, well above the government’s Minimum Support Price for farmers.

For peas, the outlook isn’t quite that simple but there are some positive signals too. Prices for both desi and kabuli chickpeas are climbing recently as government stockpiles are finally shrinking. Lately, rumours are starting to circulate that the Indian government may reduce its tariff on chickpeas, currently at 60%, to avoid food inflation. This would only indirectly affect peas, but those prices are already near record highs, a signal of tight supplies.

So in answer to the initial question, yes, India could potentially have a sizable influence in pulse markets in 2020/21. There is already a positive impact on lentils from the reduced import tariff and there is a possible light at the end of the tunnel for peas. It’s far from certain, but having China and India as two major pea buyers would certainly add a bit of “excitement” to the market.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.