Pulse Market Insight #173 OCT 23 2020 | Producers | Pulse Market Insights

Is There Any Way to Know How High Prices Will Go?

Short answer: no. It would be great if it was as simple as a formula like (CP+CO)-(SU+DP+EX)=Price, where CP is crop production, CO is carry-over, SU is seed use, DP is domestic processing and EX is exports. If only you could just drop in the variables and out pops a price.

There are a few problems with this type of approach, mainly because each one of the variables includes some serious unknowns:

- There’s more than just a little “wiggle room” in official and unofficial estimates. Crop size, domestic processing and ending stocks are very prone to slippage and adjustments. Trade data are a little more reliable but it’s usually a month or two old, so not very predictive.

- As the old saying goes, “everyone talks about the weather; no one does anything about it” and it’s the single most important factor for ag markets, by far. If someone could come up with a completely reliable weather forecast a few months out, grain prices would be so much easier to predict. Alas!

- Besides the weather, the future is simply unpredictable, as we’ve learned (in spades) in this past year or two. Changes in consumption, government trade policy, geopolitical turmoil and other developments change the outlook for better or worse, sometimes on a dime.

Multiply these unknowns by the 10 or so countries that affect each crop type and, well, you get the picture. This may sound a little hopeless in terms of price predictions, but that’s kind of the point. Predicting prices isn’t really grain marketing. Basic timeless strategies like selling into rallies and selling when prices offer a profit are still the best approach.

That said, there are a few tools that can provide some guidance. Seasonal charts are one useful guide that we’ve talked about before. People also want to know if current prices are good or not; the problem is we tend to have pretty short-term memories. A longer term view (10 years at least) can show how current prices stack up and refresh fuzzy memories.

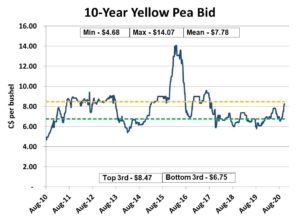

Ten years of yellow pea prices are shown in the chart below. Our latest prairie-wide average bid is $8.25 per bushel, above the long-term mean of $7.78 per bushel. By comparison, yellow peas managed to hit $14.07 per bushel in the spring of 2016. For those who like to think in “thirds” (in terms of frequency), the current bid is still in the middle third of the last 10 years. No guarantees, but this chart suggests there’s still more upside room, especially since this recent move higher already began early in the marketing year.

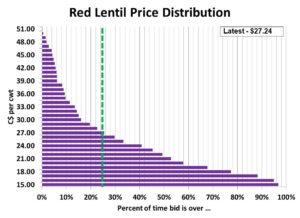

Another way to look at the market is to consider how often bids achieve various price levels. The chart below shows the range of red lentil bids over the last 10 years. Our latest prairie-wide average bid is 27¼ cents per pound. During the last 10 years, prices have been over 27 cents about 25% of the time. Sure, bids can go higher (there’s still nine months left in the 2020/21 marketing year) but they’re starting to get into “rarer air”.

While we remain skeptical that anyone can predict prices (aside from a lucky guess), the data provides helpful tools in farmers’ decision-making.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.