Pulse Market Insight #176 DEC 17 2020 | Producers | Pulse Market Insights

Pulse Markets Shrug off StatsCan Estimates

There’s a widely held belief that StatsCan reports have the ability to move markets. While there might be a small reaction for crops like canola (or maybe wheat), the effects are usually measured in minutes, not days and certainly not weeks or months. For other crops like pulses, the StatsCan estimates have even less impact.

In particular, the December yield and production numbers are released after traders have already been buying and selling the year’s crop for 3-4 months and already have a good “feel” for supply levels. Farmers too have had enough time to be able to gauge the strength of buyers’ demand. By the time the StatsCan December numbers come out, the market is already humming along on actual supply and demand factors. Even so, it’s helpful to review what StatsCan had to say about 2020 pulse crops.

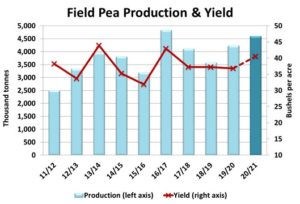

For peas, StatsCan reported the average yield this year was 40.5 bu/acre, up from 36.8 bushels last year and the third-highest yield on record. Even though 2020 acreage was down 2% from last year, production ended up at the 4.6 mln tonnes, 8% more than 2019 and the second largest crop on record.

More important than the overall increase, StatsCan also provides estimates (on request) by class of peas. This revealed some interesting differences. Last year’s large premium for green peas triggered an increase in seeded area for that class while yellow acreage actually declined. The result is that the green pea portion of the crop was actually 30% larger than last year while yellow pea production was up by only 4%. That’s one key reason why yellow pea bids are still firming up while greens already started to back off before the StatsCan report. Overall though, the larger 2020 pea crop has been unable to weigh on the market as export demand, particularly from China, has easily absorbed the production increase.

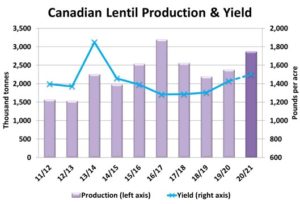

For lentils, StatsCan actually reduced its latest crop estimate from earlier reports. This latest estimate came in at 2.9 mln tonnes, down from 3.1 mln earlier but still 20% more than last year. The average prairie-wide yield came in at 1,500 lb/acre, supported by exceptional yields in southern Alberta.

Just like peas, the added details of lentil production estimate by class are more revealing. Last spring, farmers responded to market signals by boosting red lentil plantings while green lentil acreage actually declined. The stronger yields resulted in a 35% increase in red lentil production while the green lentil crop actually shrunk by 6%.

Earlier this fall, lentil bids for all classes were climbing in spite of the larger September estimate but have softened in the last few weeks. This downward revision in the December estimates has been unable to give the lentil market any support.

The chickpea production estimate from StatsCan came in at 214,000 tonnes, down 15% from last year. A stronger yield just under 1,600 lb/acre partly offset the 24% drop in seeded area. Chickpea bids had moved up after harvest but have flattened out more recently and this lower StatsCan crop estimate hasn’t been able to provide any sort of lift for prices.

The biggest surprise (in our view) in the StatsCan report came from dry beans. We knew 2020 seeded area had increased but StatsCan added even more acres and reported a record yield. As a result, the dry bean crop was pegged at 490,000 tonnes, 55% more than last year and the biggest Canadian crop on record. Even with this big increase, dry bean bids have been able to remain steady or even firm up since harvest. That’s a sign of strong export demand, mainly from Latin America and Europe.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.