Pulse Market Insight #177 JAN 8 2021 | Producers | Pulse Market Insights

Early Signals from India’s Rabi Season

It seems like all the hubbub in 2020/21 pulse markets has quieted down in the last few weeks. For the first part of the marketing year, trying to sort out supply levels drives most of the market action but then the demand factors start to kick in. That’s especially the case for pulses, where the Indian market is still a large influence for Canadian pulses, particularly for lentils.

The main factor in India that will set the tone for the second half of 2020/21 is the outlook for its domestic production in the winter (rabi) season, when Indian farmers grow lentils, peas and chickpeas. Just as a refresher, the rabi season is the drier part of the year when northeast monsoons provide a much smaller amount of the annual rainfall. Indian production of lentils and peas is concentrated in the north-central and northeast parts of the country, while chickpea plantings are a little more broadly dispersed.

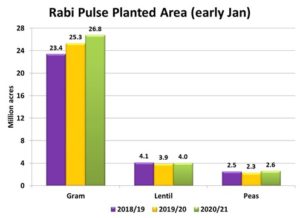

Planting of rabi crops got started in early November and is now in its late stages, without too many difficulties. According to information from the Indian government as of early January, total rabi pulse plantings are 39.4 mln acres. That’s 6% larger than last year and 7% above the 5-year average. For lentils, the difference is smaller but gram (chickpeas) and peas are further ahead of last year.

Based on this acreage information, the potential is set up for larger Indian pulse crops in 2021. And because planting got off to a slightly quicker start, the harvest schedule should be bumped up week or two, with the first harvests starting earlier in February.

Of course, between now and then, the weather needs to cooperate and that’s never a sure thing. We’re also getting mixed signals about the current situation. The maps showing Indian rainfall so far in the rabi season are indicating very low rainfall. Remember, rabi is the dry season but amounts are reported well below what’s considered “normal” for this time of year.

At the same time, satellite vegetation image maps are showing up quite green, better than average. Part of the reason could be that favourable soil moisture conditions going into the rabi season are still supporting crop growth. We also heard from a contact in Madhya Pradesh, in the middle of the core growing region, that conditions are still looking good. Even if the total rainfall is lower, smaller rains at the right time can make a big difference in crop outcomes.

Our best read on the Indian crop situation is that conditions are decent for now but will need at least a few periodic rains and moderate temperatures to pull off higher yields. Even if yields are somewhat disappointing, this upcoming harvest will still rebuild Indian supplies and reduce the need for large imports in the next few months.

That’s not to say imports will stop entirely and there will certainly be differences by the type of pulse. India doesn’t produce meaningful amounts of green lentils or green peas, so those will be needed regardless of the size of the rabi crop. Red lentil imports could be affected more and yellow peas aren’t allowed (unofficially) in the country anyway. India doesn’t really import kabuli chickpeas either, but demand for desis will likely decline.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.