Pulse Market Insight #178 JAN 22 2021 | Producers | Pulse Market Insights

What’s Happening with Pea Markets?

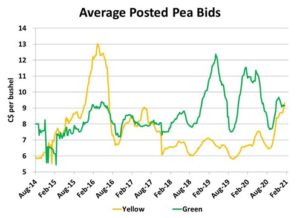

Since last fall’s harvest, there have been some strong moves for pea prices. Some of those have been fairly predictable as bids followed the normal seasonal tendency higher from the harvest lows. But it’s not all business as usual either, with some interesting changes in price relationships. In previous reports, we’ve stressed that yellow and green pea markets are very different, even though they’re often lumped together. The 2020/21 marketing year is reinforcing that idea.

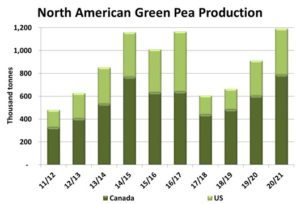

For green peas, bids moved higher from mid-September to late November before turning sideways or even slipping a little lower. This fits the normal seasonal pattern very closely, largely because supplies of green peas are actually quite comfortable. Farmers in Canada (and the US) responded to last year’s higher prices by boosting acreage and 2020 production was up roughly 30% in both countries. Prices are more likely to follow seasonal tendencies when supplies are comfortable and that seems to be the case for green peas in 2020/21.

In contrast, bids for yellow peas also had a post-harvest rally but rather than turning sideways, they’ve kept going higher. There are a couple of good reasons for that continued strength but the main one is that Canadian yellow pea production in 2020 was only up 4% from the previous year while in the US, production actually dropped 17%. Most other exporting countries saw mediocre 2020 yellow pea production as well.

From the demand side of the equation, there are also differences between yellow and green peas. The main sources of demand for green peas don’t change a lot from year to year and we haven’t seen any real increase in Canadian exports of green peas so far in 2020/21. In fact, the year-to-date total of 81,000 tonnes is actually well behind last year and slightly below the 5-year average pace.

Meanwhile, yellow pea demand is a lot more variable from year to year. China has become an even more dominant buyer of Canadian yellow peas and in 2020/21, its regular fractionation demand has been bolstered by much heavier feed use, supported by rising meal markets. So far in 2020/21, Canadian exports of yellow peas are up 11% from last year and 13% above average. The only concern is how dependent Canada is on the Chinese market.

These different dynamics are now being reflected in Canadian pea prices. The combination of comfortable supplies and routine export demand for green peas has kept a lid on those bids in western Canada. The limited supplies of yellow peas and heavier demand has caused a much stronger rally for yellows, which have now climbed above green pea prices.

A premium for yellow peas over greens is unusual but not unheard of. The price chart shows several times when yellows were higher than greens. The most extreme example was in 2015/16, when yellows hit record highs and green peas saw only moderate gains.

While we wouldn’t be surprised to see yellows remain above greens for the rest of 2020/21, this year’s situation is considerably different than 2015/16. Back then, Indian demand was driving pea prices higher and because yellow peas were substituting for desi chickpeas, there was no extra interest from India in green peas and no opportunity for greens to take the place of expense of yellow peas.

This year, with China driving most of the demand, both yellow and green peas can be used (as far as we understand) in fractionation and feed use. This means that if yellow peas become relatively too expensive, it’s easier to switch to greens and would tend to limit the premium of yellow peas over greens. It also means that if the yellow pea rally continues, green pea bids could be pulled higher as demand spills over into that portion of the market.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.