Pulse Market Insight #182 MAR 19 2021 | Producers | Pulse Market Insights

The Half-Year Export Scorecard

It’s already well past the halfway point of the 2020/21 marketing year but as far as the StatsCan export data goes, we only have August-January, the first six months. Even so, these numbers provide some direction for the second half of 2020/21.

Before digging into the numbers, it’s important to remember that exports for a number of crops are typically more heavily frontloaded in the months just after harvest. This means export forecasts for the last six months of the marketing year aren’t as simple as just taking the first six months and multiplying by two. One reason why export volumes start big and then fade is that overseas buyers are often waiting for the cheaper newly harvested supplies in order to rebuild their inventories. The other is that Canadian supplies start to run low later in the year and inhibit exports. That’s certainly the case for some crops this year.

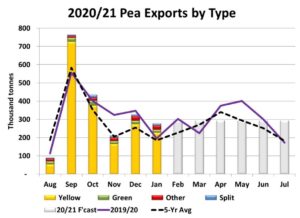

This year’s pea exports were even more heavily frontloaded than usual, with a massive 764,000 tonnes in September, the most peas ever exported in a single month. That gave 2020/21 a big head start but monthly volumes since then have also been above average. Through the first half of 2020/21, 2.11 mln tonnes of peas have been exported, compared to last year at 1.94 mln and the 5-year average of 1.77 mln tonnes. Yellow pea exports are the reason for the higher volumes this year, while greens are trailing last year’s pace.

The odds are good that pea exports in the second half will be roughly steady with the last couple of months. China has been the dominant buyer and solid volumes will continue to move there as long as there aren’t any more diplomatic “glitches”. In fact, amounts would probably be even larger if supplies were available, but Canada will largely run out of peas as the marketing year winds down.

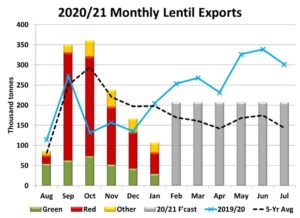

Lentil exports also started 2020/21 on a very strong note with big volumes in September and October but shipments dropped off sharply in December and January as India’s higher import tariffs came back into effect. Through the first half, exports of red lentils are well ahead of the last three years while greens have been roughly steady.

Lentil exports normally decline later in the year but 2019/20 was a big exception, helped by increased demand from India. Whether that’s going to happen again in 2020/21 is doubtful, at least not to the same extent. India has just harvested its own lentil crop and nearly a million tonnes of red lentils are reported to be available in Australia. Even so, Canadian stocks will be fairly low by the end of 2020/21.

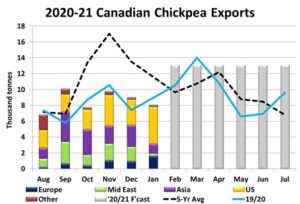

The news isn’t quite as positive for chickpeas. Export volumes have been well below average even before the start of 2020/21 and haven’t shown any seasonal “bump”. As far as we can tell, the main difficulty for chickpeas has been very strong competition from Russian chickpeas into South Asia. We’re trying to be optimistic that volumes will improve in the second half, but that may be wishful thinking.

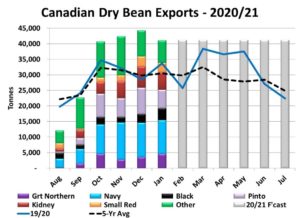

The real rockstars of Canadian pulse exports this year are dry beans, which are running at a record pace and have been moving out at more than 40,000 tonnes per month since harvest. That’s a good thing since StatsCan reported the 2020 crop was 55% larger than a year ago. Demand has been exceptionally strong from a number of destinations, including Latin America, and that will likely continue through the remainder of 2020/21.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.