Pulse Market Insight #183 APR 5 2021 | Producers | Pulse Market Insights

Possible Market Signals from US Acreage Estimates

It’s still another month until StatsCan issues its seeding intentions estimate but this week, we got some possible clues about the direction in pulse acreage, courtesy of the USDA’s Prospective Plantings report. While there are plenty of differences between the US and Canadian pulse markets, we can observe the USDA’s estimates to see what might apply in western Canada and what doesn’t.

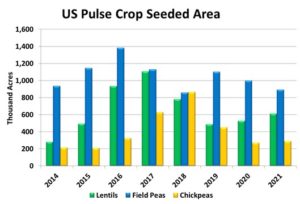

On the surface, there were a number of surprises in the US acreage estimates but on further examination, we can see some reasoning behind the estimates. That said, the year-over-year changes for the three crops shown in the chart below may not be large enough to trigger a price response, either higher or lower.

For peas, 2021 seeded area was estimated at 893,000 acres. That’s 11% less than 2020 and the second straight year of declines. Based on signals north of the border, including extremely strong Canadian exports and price levels for yellow peas, this decline seems a little overdone. In the US however, pea prices haven’t risen to the same degree as exports to China have been penalized by duties. In addition, a larger portion of US peas are green varieties and those prices haven’t seen the same strength.

As a result of the less exuberant price signals south of the border, it’s not too surprising that US acres could decline again in 2021. This doesn’t necessarily mean Canadian acres will follow suit but seeded area in western Canada could end up flat or see only small increases.

On the other hand, US lentil seeded area is estimated at 611,000 acres, 16% more than a year ago and the second straight year of gains. While a small increase might be expected based on historically strong lentil prices, it’s worth noting that the large majority of the US crop consists of medium green lentils. In general, prices for greens have performed better than reds, so it’s not all that surprising to see an increase in US plantings.

This could provide a few clues about Canadian lentil plantings, although more of Canada’s lentils are red varieties which haven’t rallied quite to the same degree as greens. More importantly, lentils occupy a much larger portion of Canadian crop rotations and disease concerns mean there’s more caution among growers north of the border about expanding acres. Still, a small increase is certainly possible.

One of the surprises in the US plantings data was the chickpea number with 290,000 acres, 8% more than last year. Prices have been moving up more recently, which may have triggered the increase and there seems to be more domestic chickpea demand in the US than Canada. As a result, more chickpea acres are possible in the US. More serious disease concerns in western Canada will still likely restrict 2021 seeded area though.

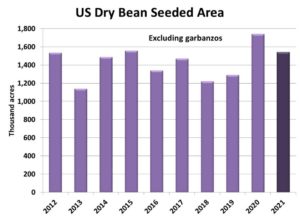

One of the other surprises in the USDA data was the dry bean estimate at 1.54 mln acres. Even though that’s down 11% from last year, it’s still historically high. Last year’s record area of 1.74 mln acres was triggered by extreme prices and this year’s bids certainly aren’t at those same levels. We had been expecting a larger decline in the US, and a sizable drop is also expected in western Canada.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.