Pulse Market Insight #188 JUN 25 2021 | Producers | Pulse Market Insights

Some Answers Coming for Supply-Side Questions

Early next week, StatsCan will issue an update for 2021 seeded area. The only acreage estimate so far from StatsCan came back in late April and that was based on a survey of farmers before most planting had started. This latest estimate will be based on a larger survey conducted from mid-May to mid-June. As long as farmers weren’t trying to hoodwink StatsCan (no guarantees), it should provide some good answers to acreage questions.

Even though it’s a bigger and more recent survey, we’d be surprised to see large-scale changes in these latest results. One sign that the early StatsCan survey findings were reasonable was the lack of “outrage” over the numbers. That tells us “the trade”, including farmers and buyers, were comfortable with the estimates.

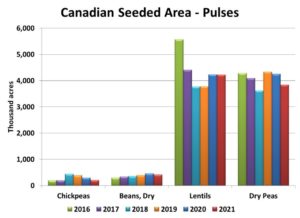

Just as a refresher, back in April, StatsCan had pegged 2021 seeded area of peas at 3.84 mln acres, nearly 10% less than 2020. For lentils, acreage was reported at 4.22 mln acres, almost unchanged from last year. Meanwhile, seeded area of chickpeas was reported down 29% at 212,000 acres and dry bean plantings were at 414,000 acres, 9% lower than last year’s peak.

One new bit of detail from this larger June survey is a breakdown of acres by class. That information is just as important as the overall crop acreage, since each type of pulse has its own separate market. Price signals have given us some clues about how acreage will shift.

For example, we fully expect most of the drop in pea acreage will occur in green peas. Because of the stricter quality requirements for green peas, a sizable premium of $2.00 or more is usually needed to persuade farmers to shift acreage toward greens. Prices during 2020/21 and new-crop bids aren’t showing any sort of premium for greens, so those acres will have declined the most, although a small reduction is expected for yellow peas too.

The situation for the various lentil classes isn’t quite as clear-cut. Red lentils are generally seen as having less quality risk, so a premium for green lentils is typically needed to attract acres too. Both old-crop and new-crop bids for large green lentils have been leading other classes for months, but reds have also performed well. Meanwhile, small greens and other minor classes haven’t done as well. Our guesstimate is that red lentils will have picked up a few acres at the expense of other classes, especially the smaller ones.

These acreage numbers are only one part of the supply picture but are helpful. Now the focus will shift to yield prospects and there are renewed concerns about dry conditions after a bit of a rain respite earlier this year. Because key pulse diseases are affected by moisture, there’s a fine balance between “good dry” and “bad dry” and for crops further south, that balance may be shifting toward the negative. And it’s worth noting that even with average yields, supplies of most pulses in 2021/22 will be on the tight side, so there isn’t much room for lower output.

Beyond the potential yield outcomes, the demand side of the balance sheet is just as critical but the questions marks here are even larger. Trying to outguess governments in India and China about import policy borders on the impossible. Still, signals about demand from these (and other) countries are still mostly positive. More on that in a later report.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.