Pulse Market Insight #189 JUL 13 2021 | Producers | Pulse Market Insights

Seeded Area of Peas Takes Back Seat to Conditions

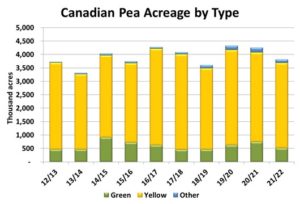

Big changes weren’t expected in the StatsCan June acreage estimate for peas and that’s exactly what happened. Back in April, StatsCan had reported survey results for pea seeded area at 3.84 mln acres and the latest estimate was almost identical at 3.82 mln acres. That’s 10% less than last year, with seeded area in Alberta shrinking the most to 1.48 mln acres, down 14% and the lowest since 2015.

We had also expected acreage of green peas to drop the hardest. After all, a sizable premium is usually needed to encourage more green pea acres and through most of 2020/21, yellow pea prices were actually higher than greens. As a result, seeded area of green peas dropped 31% in 2021 while yellow pea plantings were down only 5% from last year.

On their own, these acreage estimates are already friendly for the 2021/22 marketing year. In our analysis, we usually pencil in average yields until more is known about the growing season. Even when we were using the 5-year average yield for the prairies at 39 bu/acre, supplies next year were projected to shrink by roughly 500,000 tonnes. It’s clear now though that an average yield is no longer possible.

There are lots of suggestions about where yields could end up. Pictures on Twitter mostly look dismal, but those can be selective. We also get phone calls, messages and emails with people’s take on crop conditions. All these sources are helpful to get up-to-date reactions from specific locations or regions.

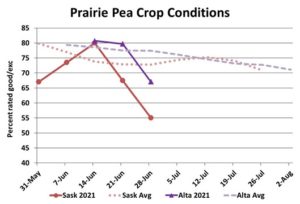

We also use provincial crop reports, which rate conditions over larger areas. These are useful as they can be tracked over the growing season and compared from year to year. Early in the summer of 2021, pea crops were looking fairly favourable in both Alberta and Saskatchewan. Around mid-June, pea crop ratings in both provinces were actually above the 10-year averages.

Over the next two weeks though, crops deteriorated rapidly due to extreme heat and lack of rain. The latest available ratings as of the end of June showed 67% of Alberta peas were rated good or excellent, 10 points less than the 10-year average. The drop-off in Saskatchewan was even more severe, falling to 55% good/exc versus the 10-year average of 73%. Since then, rain has fallen in parts of Alberta which may have stabilized conditions in those areas. Elsewhere, there hasn’t been much help for the crop.

The tricky part now is trying to correlate these crop ratings (and how they’ve changed in the past 10 days) with yield outcomes. If there is a silver lining to the dry conditions, it’s that the diseases which reduced pea yields in the last couple of years aren’t much of a problem. In areas where the pea crop looks okay, that may actually help save some yields. Of course, yields in the more serious drought areas will have dropped far more.

Typically, we’re cautious in adjusting yields (we’ve overreacted in the past) but are pretty confident the prairie-wide yield will be at least 10% below average, with more downside potential. This initial adjustment would put the total yield at 35 bu/acre and drop the 2021 pea crop to 3.57 mln tonnes. That’s already a million tonnes smaller than the 2020 crop and adds to the “friendliness” for the supply side of the 2021/22 balance sheet. Stay tuned though; the story isn’t finished yet.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.