Pulse Market Insight #190 JUL 26 2021 | Producers | Pulse Market Insights

What Does the Latest News from India Mean?

While most eyes are focused on the deteriorating situation for Canadian (and US) pulse crops, there have been developments in India, particularly changes and reversals in government policy. This has the potential to add a little more “excitement” to pulse markets in 2021/22, especially for lentils.

Overall, the approach of Indian agricultural and trade policy is to balance the interests of farmers, which make up a large percentage of the population, with consumers. Just like every other democracy, Indian politicians are largely interested in getting re-elected. To keep its farmers happy, the government intervenes in the market to keep prices high. But frequently, it also tries to rein in food inflation for consumers by limiting how high prices go. Being a politician in India isn’t easy.

Just a few weeks ago, the Indian government brought in stock limits on pulses for participants in the distribution system. This was intended to limit “hoarding” that was supposedly raising prices too high, even though most pulses were already below the government’s minimum support price. In essence, this meant retailers, wholesalers, distributors and importers could only hold 200 tonnes of pulses. Anything beyond that had to be liquidated.

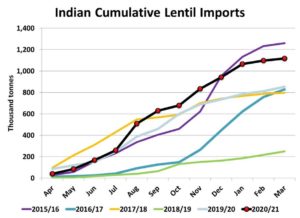

This surprise announcement essentially caused pulse trade with India to screech to a halt. After all, how could an importer bring in a vessel of lentils when the most they could hold in inventory was 200 tonnes (10 containers). Even though there’s very little farmer selling going on in western Canada, bids slipped a few cents on this news. In the case of lentils, Canada still relies very heavily on Indian demand and in 2020/21, Indian imports hit 1.1 mln tonnes, the second highest on record.

Understandably, this announcement caused serious pushback. A whole series of meetings between Indian traders and government officials took place. The good news is that the Indian government backed off and revised its order, removing the stocks limit entirely for importers and allowing wholesalers to hold 500 tonnes, which should help restart trade.

Immediately following this latest update, lentil bids in western Canada started moving higher again. That said, there’s the “minor issue” of a drought on the prairies that’s reducing pulse supplies. Between the Canadian crop losses and the Indian government’s announcement lentil prices are getting support, although it’s hard to nail down how much each factor is contributing.

Other things haven’t changed though. The 33% import tariff on lentils is still in place, at least for the time being. Supplies of Indian lentils are low and that’s driven prices higher. These strong prices mean there’s still a good chance import tariffs will be lowered in the coming months, at least for lentils.

For peas, these orders for stocks limits haven’t had any real effect. The Indian government is still barring pea imports with quantitative restrictions and much higher import tariffs. Prices for both peas and desi chickpeas in India have been soft lately, meaning there’s not much incentive for the government to lower import barriers on peas.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.