Pulse Market Insight #191 AUG 20 2021 | Producers | Pulse Market Insights

Looking Back for Clues About the Future

“Unprecedented” has to be one of the most overused words in the past few months, but it certainly applies to crop markets this year, and in a good way. Over the past few months, prices for crops like canola and barley hit record levels even before the drought had an impact. More recently, pulse prices have been taking off, but are they in “unprecedented” territory? And if not, can they get there?

Whenever a market rallies, it always raises the question of how high prices can go. The sharp rise in pea, lentil and chickpea prices has been triggering those questions in the last month or two. While each year’s market conditions are unique (and 2021 could be more extreme than any other), past history is the best place to start when looking for upside potential. It’s not foolproof but in some ways, the old price highs provide hints about where the market might start to rebalance itself.

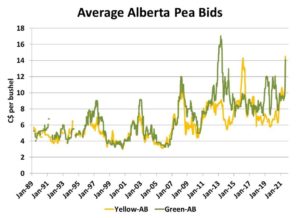

The chart shows the long-term history of posted elevator bids for peas in Alberta but doesn’t capture those few extreme sales that some people may remember. Even so, it indicates that for green peas, the absolute peak happened back in April 2013 when the average bid was just beyond $17.00 per bushel. So far in 2021/22, elevator bids are averaging just over $14.00 per bushel, but it’s still early in the marketing year. Keep in mind that a good chunk of the carryover from 2020/21 consists of green peas.

For yellow peas, the latest price is $14.50, already past the previous high set back in March 2016, when India was desperately trying to import peas to counter its own drought situation. Yellow pea prices in 2021/22 are truly in “unprecedented” territory. This year is different in that India is no longer a pea buyer and China dominates the market, based on fractionation and feed demand, slightly different than India’s demand for dal.

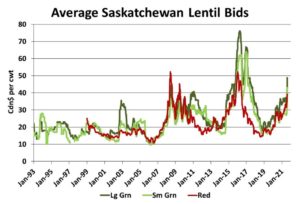

Prices of lentils have also been shooting higher in response to drought conditions and rising demand from India and Turkey, among others. Even so, current bids are still well below the old highs. Large green lentils peaked at 76 cents in April 2016 while small greens hit 63 cents in January 2017. Meanwhile, red lentils have been a little beyond 50 cents a couple of times, in June 2008 and January 2016. To repeat, a few farmers may have sold above the recorded highs; the chart shows average posted bids.

Just because lentil prices have been higher in the past doesn’t ensure they’ll get there again in 2021/22. But we also know that this year’s circumstances are extraordinary. The full extent of the crop losses aren’t yet known but it’s clear that yields are the poorest in years. At the same time, it’s also apparent that key lentil buyers are short of supplies and are anxiously looking to lock in supplies.

The other feature that’s different this year is that even farmers who have peas or lentils available to sell are holding them off the market. That strategy has been paying off handsomely and so far, there aren’t any signals to stop riding the rocket higher. In fact, it seems farmers’ (understandable) reluctance to sell is adding even more upside to the market.

To be blunt, trying to predict a top in these types of markets is mostly just guesswork. That said, there’s nothing wrong with having lofty targets. We simply hope this illustration of price history will add a little more structure to the thinking process.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.