Pulse Market Insight #192 SEP 3 2021 | Producers | Pulse Market Insights

What Do the StatsCan Estimates Have to Say?

This week, StatsCan issued its first estimate of 2021 crop yields and production. For 2021/22, there’s a lot more at stake in these estimates, because the extreme conditions have buyers and sellers guessing (even more than usual) about the crop size. After all, when the trade estimates for the pea crop range from 2.4 to 3.8 mln tonnes and lentils are from 1.6 to 2.6 mln tonnes, it tells you there’s a lot of uncertainty.

This week’s estimates from StatsCan come from its yield models using satellite images of vegetation. These models, based on the relationship between “greenness” and yields, have been developed over many years, but they have rarely seen conditions like this year over such a wide area. So there’s still room for surprises when the final yield estimates based on farmer surveys are done in late November. For now though, these estimates are a good starting point.

One other note about these StatsCan estimates is that while they take a reasonable look at yields, there wasn’t any recognition that more fields were written off and left unharvested in 2021. StatsCan used a long-term average abandonment to come up with its production numbers. That’s another reason why the final survey-based production estimates will likely be lower.

For peas, StatsCan reported a 2021 yield of 25.9 per acre, almost 15 bushels lower than last year and 33% less than the 5-year average. Using StatsCan’s harvested area, production came in at 2.63 mln tonnes, but we would expect fewer acres were taken to harvest which could mean a crop closer to 2.5 mln tonnes.

Those individual estimates appear serious and when taken together, they mean a 2021 crop at least 2.0 million tonnes smaller than last year. And with the shift in seeded area away from greens and toward yellows, the decline is even greater for green peas. The smaller crop means a sharp reduction in the 2021/22 export program and the process of rationing that demand through higher prices is well underway.

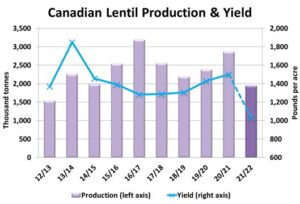

StatsCan pegged the lentil yield at 1,030 pounds (17.2 bushels) per acre, 24% below average and the lowest yield since 2003. The StatsCan production estimate came in at 1.97 mln tonnes although we expect a few more acres were written off which would bring the total a little lower yet. If so, that would mean a 32% or 930,000 tonne drop in the 2021 crop compared to last year.

Based on earlier acreage reports, green lentil production will drop more than reds, but both portions will see significant declines. At the same time, demand has been rising from key importers like India and Turkey, which is helping drive prices even higher.

The biggest decline in StatsCan’s pulse crop estimates was in chickpeas, with a record low yield of 780 pounds (13 bushels) per acre. Based on some discussions we’ve had, that yield number may be a bit too low but regardless, the crop has fallen sharply. Seeded area was already 38% less than last year and with a yield roughly half of a year ago, StatsCan is estimating the 2021 crop at 60-65,000 tonnes, 72% smaller than a year ago. The chickpea crop is also sharply reduced in the US, which is the main factor behind sharply rising bids in western Canada.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.