Pulse Market Insight #194 OCT 1 2021 | Producers | Pulse Market Insights

How is Pea Demand Responding to Low Supply Environment?

In a year like 2021 with a sharp drop in supplies, one of the key variables in the outlook is how buyers are adjusting to the new environment. With Canadian pea supplies almost 2 million tonnes lower than last year, it’s clearly not business as usual. The higher prices, in some cases new records, are forcing changes in usage and trade. Some of those effects are short-term but others may linger for a number of years or perhaps even permanently.

When looking at the price outlook for 2021/22, it’s important to sort out the elastic from the inelastic demand. In other words, which type of demand will fade as prices rise and which buyers will stick around even if prices go higher. These exact amount of these types of demand are difficult to nail down, but shifts have already been taking place early in the marketing year.

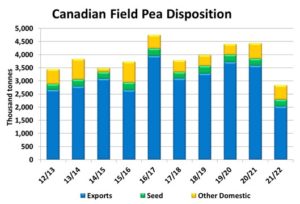

The chart shows at least 1.6 mln tonnes of pea consumption will need to be cut in 2021/22 based on current estimates of supplies just under 3.0 mln tonnes. The easiest part of the outlook is to forecast steady or slightly higher seed use next spring. There’s a good chance seeded area in 2022 will be unchanged or expanded a bit. From there, the picture gets a little murkier.

The “other domestic” use number shown by StatsCan is a combination of feed, food and processing but the split between those channels isn’t 100% clear. We know that pea fractionation facilities are looking to operate at full capacity this year, which would mean roughly 250,000 tonnes of consumption on top of other processing that’s going on. Both seed and processing use are fairly inelastic demand and won’t be affected as much by higher prices.

Feed is the other part of the “other domestic” category and that’s harder to pin down. Certainly, high prices for peas will discourage their use in rations but it’s not as if other feed sources are exactly cheap either. Soymeal as a source of protein could push out some peas. Within overall domestic use, it’s quite possible the drop in feed use will be offset by the increased processing, leaving the total amount close to unchanged.

The largest drop has to occur in exports as it’s the biggest category of usage. China is the dominant buyer of Canadian peas, taking over 70% of last year’s total. Roughly half of the 2.6 mln tonnes taken by China in 2020/21 was used in feed markets there. The high pea prices have already discouraged 1.3-1.4 mln tonnes of demand.

Among other buyers of Canadian peas, there’s a mix of elastic and inelastic demand. Some of the more variable demand would come from countries like Cuba and Bangladesh, which typically take more yellow peas. Volumes to those destinations could be pared back due to the high prices, and that fading demand would tend to limit further upside for yellow pea prices.

In general, users of green peas tend to be more persistent buyers, as there are no real substitutes in the canning and packaging industries. This raises the potential for those prices to show even more strength later in 2021/22.

Looking a little further out, these sources of demand for Canadian peas aren’t expected to shift much next year either. Because 2021/22 ending stocks will be minimal, supplies will be tight in the following year, unless 2022 yields are massive. This will make it challenging for domestic and export users once again.

The current supply situation for Canadian peas will also have ripple effects over the longer term in other countries. We’re hearing China could be opening its borders to peas from Ukraine and Russia, largely because of China’s desire to diversify its sources. The 2021 crop situation highlighted how vulnerable it is to reductions in Canadian supplies. This adds more urgency to trade negotiations with countries in the Black Sea region. And once those doors are open, they’re going to stay that way and will encourage more pea production in some of those origins. This means Canada will have more competition in China and other markets.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.