Pulse Market Insight #198 NOV 26 2021 | Producers | Pulse Market Insights

Early Trade Data Already Revealing Shifts in 2021/22

It was clear by midsummer that exports of Canadian crops would need to slow down sharply as yield estimates were rapidly ratcheted lower. There simply wasn’t going to be enough tonnage to keep up a normal pace, let alone the extremely heavy volumes that occurred in 2020/21.

Early on, importers of Canadian crops had been fairly complacent about booking the 2021 crop but started to get concerned and began buying more heavily in late July and especially August. This began the process of rationing demand as the stronger buyers bid up prices while the more price-sensitive customers looked elsewhere for alternatives and backed away from the market.

The historically high prices in the first few months of 2021/22 mean “the market” is doing (or has done) its job of leaving only the most committed buyers still bidding aggressively. But the high prices have also changed trade patterns, including for pulse crops.

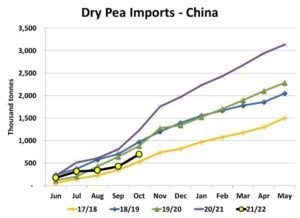

Regular readers know that China is the dominant buyer of Canadian peas, so that’s the most important place to watch. Chinese pea imports – almost all from Canada – turned higher in October, at 272,000 tonnes. That’s normally the time of year when import volumes jump, but it’s still far less than the 423,000 tonnes last October. So far in China’s 2021/22 marketing year, pea imports are just under 700,000 tonnes which is the lowest since 2017/18, back when India was still a major buyer.

There was no question that small Canadian supplies would limit Chinese purchases below the last few years, but there are some other cautions too. It’s worth noting that Chinese imports were already quiet back in late summer when trade was still based on old-crop Canadian supplies. It’s generally believed roughly half of Chinese demand last year came from the feed channel. The current prices for peas simply aren’t feasible for feeders, and that’s where the demand has been rationed.

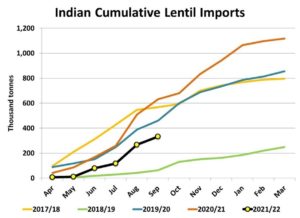

When it comes to lentils, especially red ones, India is still the destination to watch and it’s a similar picture to the yellow pea market. Earlier in 2021, there was a general feeling that India would need to ramp up its purchases of lentils, based on ideas of its small rabi crop in early 2021. It turns out that hasn’t been the case. In fact, Indian lentil imports through the first half of 2021/22 were 331,000 tonnes, less than half of last year’s pace and the slowest since 2018/19.

Just like for China’s pea purchases, the slower pace of Indian lentil imports started well before there were concerns about Canadian lentil crops. At least until July or August, the lower imports weren’t simply caused by high prices. With Canadian bids only starting to rally in late July or early August, the higher-priced lentils would only start arriving in India in September or later. The impact of high prices on Indian demand will become more noticeable in trade data for October and beyond.

While the 2021 drought has undoubtedly had an effect on export volumes, it may not be the explanation for all the reduced demand. In any case, we’re expecting Canada will be almost completely sold out of peas and lentils by the end of 2021/22, and the exact cause of lower exports may not matter all that much. But it is something to watch for when crops recover to a normal size, hopefully in 2022.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.