Pulse Market Insight #199 DEC 23 2021 | Producers | Pulse Market Insights

Smaller Pulse Crops Reported by StatsCan but No Big Surprises

Earlier this month, StatsCan issued its 2021 crop estimates based on its largest farmer survey of the year. Earlier estimates from StatsCan had used remote-sensing information and data models to come up with yield estimates. The December estimates are generally viewed as the final word on crop size, but we know from experience that revisions can show up down the road, especially once Ag Census data is calculated later next year. Sometimes, those census adjustments can be large.

In any case, these StatsCan estimates are the most comprehensive numbers available. That is, unless someone else is surveying 27,000 farmers to get their yield numbers. With this release, StatsCan also provides a separate production breakdown by class/type for a number of crops, which is particularly helpful for pulses. That said, as the survey sample size is sliced and diced into smaller pieces, the statistical accuracy is reduced.

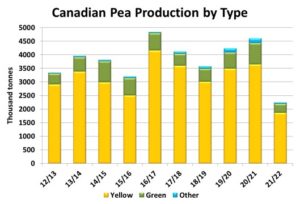

According to StatsCan, the 2021 pea crop came in at 2.26 mln tonnes, lower than the average trade guess at 2.5 mln tonnes. The 51% smaller crop was driven by a combination of a 10% drop in seeded area and a yield that was 42% below the 5-year average. One question mark about the StatsCan estimate is the minimal adjustment it made to harvested area, showing abandonment of only 3.5% versus the long-term average of 1.9%.

When we look at the breakdown by type, yellow pea production was 1.87 mln tonnes, down 49% from last year, while the green pea crop was only 334,000 tonnes, 57% smaller than a year ago. The “other” class (with cautions about small sample size) is reported at 51,000 tonnes, 69% smaller than a year ago. The larger old-crop carryover from 2020/21 means supplies haven’t seen quite the same size of declines, but are down 43% from last year for both yellow and green (and minor classes) peas.

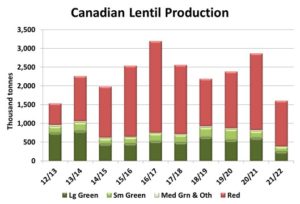

StatsCan reported the 2021 Canadian lentil crop at 1.61 mln tonnes, 44% smaller than last year and roughly 200,000 tonnes less than its September estimate. This was also lower than the average trade guess at 1.80 mln tonnes. StatsCan didn’t trim harvested area much but the overall yield at 835 lb/acre was the lowest since 2002.

StatsCan used its June acreage breakdown along with individual yields for the various classes to report large green lentil production at 244,000 tonnes, down 60% from the 603,000 tonnes in 2020. Small green lentil production was pegged at 134,000 tonnes, 30% less than last year and other classes dropped to only 13,000 tonnes, 63% less than last year (with cautions about small survey sample size). The red lentil crop was estimated at 1.22 mln tonnes, 41% smaller than last year at 2.04 mln tonnes.

According to StatsCan, the 2021 chickpea crop is 76,000 tonnes, 64% less than last year and the smallest crop since 2009/10. This crop, based on a yield of 924 lb/acre with no real reduction in harvested area, was actually a small increase from StatsCan’s September estimate. This slight upward adjustment by StatsCan in December isn’t really large enough to change the supply picture and won’t likely have any price impact.

The StatsCan data for the 2021 dry bean crop is still a bit “patchy”, but the overall crop estimate came in at 386,000 tonnes, up from its previous total at 352,000 tonnes but 21% less than last year’s high point. Production of white beans was 120,000 tonnes, 28% less than last year while the coloured bean crop was pegged at 265,000 tonnes, 18% lower than 2020. Despite the smaller crop than last year, Canadian bean supplies are still relatively comfortable, although the situation varies for western and eastern production regions.

The Canadian fababean crop was reported by StatsCan at 73,000 tonnes, 41% lower than last year but up sharply from its previous estimate at only 41,000 tonnes. The smaller crop was in spite of a 34% increase in seeded area but the yield of only 21.6 bu/acre was 52% lower than the 5-year average.

It may seem obvious, but it’s worth stating that a smaller crop estimate doesn’t actually reduce physical supplies. Buyers are still facing the same tight supplies as before the StatsCan report. Only perceptions have changed.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.