Pulse Market Insight #203 FEB 24 2022 | Producers | Pulse Market Insights

Update on India

In the Indian production calendar, this is late in the rabi (winter) growing season, with harvest just getting underway. The rabi season is when pulses that most directly affect Canadian farmers – chickpeas, lentils and peas – are produced in India. These crop outcomes will help determine what type of demand will be coming from India in the next year.

We’ve been tracking planting progress and weather in India since the beginning of November to get an idea of rabi crop potential. According to the Indian Ag Ministry, seeded area of chickpeas is up 2% over last year and 10% above average while lentil area is 7% more than last year and 6% more than average. Pea plantings however were reported to be down 5% from last year and 6% below average. This set the stage for larger chickpea and lentil production but less for peas.

Rainfall has been above average for most of India during the rabi season. Keep in mind, this is the drier part of the year but anecdotal reports are telling us rabi crops are looking quite favourable. Satellite vegetation maps are confirming those positive reports.

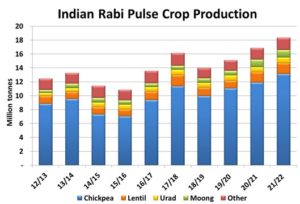

The Indian government just released its 2nd Advance Estimates, with its first projections for the upcoming rabi harvest. Total rabi pulse production is estimated at 18.3 mln tonnes, 9% more than last year. The lentil crop is estimated at 1.6 mln tonnes, 6% above last year while the chickpea crop is pegged at 13.1 mln tonnes, 10% above last year. There isn’t a specific estimate for peas but the “other” category of rabi pulses was reported to be 9% more than last year.

This outlook, with the crop ready to be harvested, puts a damper on India’s import prospects. Canada doesn’t typically export chickpeas to India but yellow peas have been a substitute for desi chickpeas in the country. India hasn’t allowed meaningful pea imports for a couple of years now and a larger desi chickpea crop means that decision won’t likely change. India also exports large calibre kabuli chickpeas, and this could make it a larger competitor in other markets.

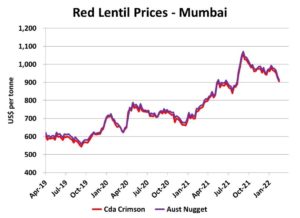

For lentils, this bigger crop will reduce India’s import needs. India has already been importing fewer lentils in 2021/22 than the year before and this will likely reduce that trade further. That’s why it was puzzling this week when the Indian government dropped import tariffs on lentils (except from the US). Lentil prices in India were already declining, which left traders in India scratching their heads about this decision. In the end though, the lack of tariffs may not have much impact on the volume of trade.

The result for Canadian pulse prospects varies depending on the crop. For peas, India has already been out of the market for a while and this won’t have any meaningful impact on Canadian exports, which have relied heavily on China for several years. For lentils, especially reds, demand from India will shrink which means Canada will need to compete more aggressively in other destinations. Canadian kabuli chickpeas aren’t exported to India anyway, but more Indian kabulis will add to global supplies, especially for the largest calibre product.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.