Pulse Market Insight #204 MAR 4 2022 | Producers | Pulse Market Insights

Good New-Crop Bids Aren’t the Whole Story

A bit of perspective can be very helpful in looking at markets and marketing opportunities. The price of a crop can be compared against various benchmarks, each of which can make current bids look good or bad. This is especially true in a year like 2021/22, where most crops have seen extremely high prices, leading to some “interesting” comparisons.

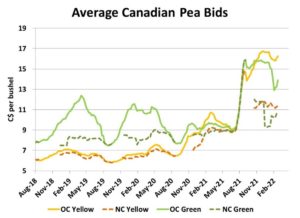

In the pea market for example, yellow pea bids hit record highs last fall and have been close to that level ever since. Green pea bids also took off at the same time but have lost ground since then. Even with those declines, green peas are still very much in the top third of the market (with a small bounce lately).

Likewise, new-crop pea bids can be viewed in a couple of ways, depending on the yardstick used. On one hand, if they’re compared against old-crop prices, they could be seen as disappointing, $3.00-5.00 per bushel lower than the current spot market.

This type of comparison is based on the idea that next year’s conditions will be roughly the same as they are right now, and that’s not likely. While it’s impossible to predict future events, we know something affecting supply and/or demand will change in the coming months. Keep in mind that almost every year, new-crop bids are lower than spot prices; the difference this year is the size of the new-crop “discount”.

Another way of looking at these bids for fall delivery is to compare them against new-crop bids at this same time in previous years. From that perspective, prices for fall delivery of yellow peas around $11.00-12.00 per bushel are far better than any other year and new-crop green pea bids of $10.50-11.00 also look very positive.

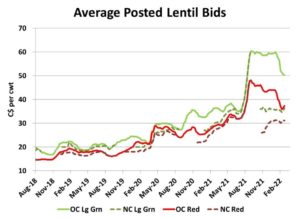

Lentil prices have shown some of the same patterns as peas. After racing higher last fall, old-crop bids for green lentils remained firm through the early winter but have turned lower more recently. Red lentil bids started to come off the highs earlier and have dropped off more since mid-January. Even though these current old-crop prices look disappointing (compared to the highs), large green lentils around 50 cents per pound and red lentils in the 35-40 cent range are still historically high.

New-crop bids for lentils are well below spot prices and the comparison to new-crop bids a year ago isn’t as favourable as it is for peas. Both large green and red lentil new-crop bids aren’t better than last year at this same time. From a longer-term perspective though, new-crop bids for large green lentils in the mid-30s and reds in the low 30s are quite strong.

Probably the best way to evaluate new-crop pulse bids is by plugging them into crop budgets to look at projected returns for the coming year. Of course, yields and production costs are very different for each farm and it’s beyond the scope of this article to say whether returns based on these prices are good, bad or indifferent. And of course, the projected returns for peas would be compared against other crops, many of which also have very attractive new-crop bids.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.