Pulse Market Insight #209 MAY 27 2022 | Producers | Pulse Market Insights

Ending Stocks Tight but Manageable

The 2021/22 marketing year has been one for the books. Once-in-a-generation (we hope) low yields triggered extremely high prices; in some cases, record highs. Now we’re in the home stretch of 2021/22 and the focus is shifting to next year. In general, there’s more optimism about the 2022 crop but that also raises questions about what old-crop supplies will look like and how they will affect the market.

On top of the 2022 crop, there will be carryover from 2021/22. Last fall, amid the crop failure, it looked like there would be essentially nothing left by the end of the marketing year. But as markets tend to do, the high prices discouraged demand and it turns out there will be some pulse supplies still kicking around by July 31. Not a lot, but more than nothing.

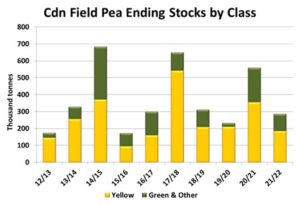

For peas, the record prices eliminated roughly a million tonnes of demand from Chinese feeders as they switched to cheaper feed sources. Other price sensitive buyers also cut their purchases or backed away entirely. Exports in 2021/22 will end up around 1.9 mln tonnes or less, 1.7 mln less than the last year. That will leave close to 300,000 tonnes of stocks at the end of 2021/22.

Those stocks would be about half of 2020/21, but not extremely low. That said, those peas aren’t readily available to the market as it seems farmers still with peas are holding them with “strong hands”. We also expect a good chunk of those will be green peas, which haven’t seen strong demand in 2021/22.

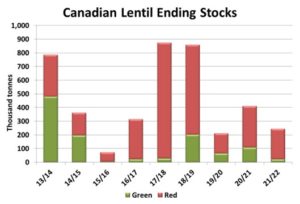

It’s a similar story for lentils. The 2021 crop was only 1.6 mln tonnes, 1.2 mln less than the previous year. But in response to the high prices, importers backed off and Canadian exports for 2021/22 will likely end up close to 1.45 mln tonnes, down 900,000 tonnes. This would leave ending stocks around 250,000 tonnes.

Again, just like peas, these ending stocks are toward the lower end of recent history but not all bins will be empty by July 31. At this point, the main support for prices is that farmers still holding lentils aren’t interested in selling, so the lentils aren’t really available.

One of the things we learned in 2021/22 is that exports weren’t cut back because supplies ran out, but rather by high prices. And that process of demand rationing started early in the year. It’s very difficult (or impossible) to drain supplies down to “nothing”. We would add a caution too. If, as we hope, the 2022 crop is considerably better than last year and supplies are bigger, it’s a stretch to expect prices will go even higher from here.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.