Pulse Market Insight #216 SEP 16 2022 | Producers | Pulse Market Insights

Trade Performance in 2021/22 and Look Ahead to 2022/23

The 2021 drought did a serious number on Canadian pulse exports in 2021/22, no question about it. In total, Canadian pulse production dropped 3.8 mln tonnes from the year before and exports dropped along with it. Importers either did without or, where possible, made shifts to other suppliers or other products. These adjustments to raise the question of whether the effects of the 2021/22 shortfalls have changed trade patterns going forward.

As pulse prices rose sharply in the fall of 2021, importers started to back away from the market. Some were more price-sensitive and exited the market earlier while others continued to buy even as prices reached (in some cases) record highs. We learned a lot in 2021/22 about how “elastic” the demand was from various buyers. Now, with prices off last year’s highs, we’ll see whether demand will return to some sort of normal in 2022/23.

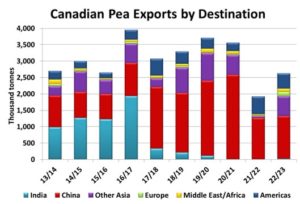

Canadian pea exports dropped 47% to 1.9 mln tonnes in 2021/22, the lowest since 2004/05. Just as telling as the total volumes were, destinations dropped to only two sizable customers, the US and China. Exports to the US were actually four times the size of the year before, mainly because the US had an equally serious 2021 drought in its pea growing areas. On the flipside, 2021/22 exports to China dropped by more than half from the year before. Food and fractionation processors in China stayed in the market but those who bought peas for livestock feed were priced out of the market.

Looking ahead, the US pea crop in 2022 was disappointing again but better than last year, and its imports will slip a bit. Pea prices are still too high for Chinese feed users though and that demand won’t come back unless pea prices drop or soymeal prices rise. India isn’t expected back either. A bright spot is seen in some other countries that weren’t prepared to pay record pea prices last year are coming back to the market at current levels. Whether they would keep buying if prices would go up isn’t as clear.

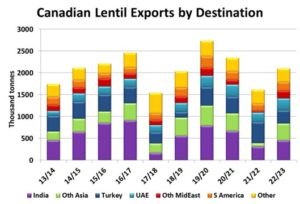

Lentil exports weren’t hit quite as hard as peas but did drop to 1.6 mln tonnes in 2021/22, 31% less than the year before. The main exception to the decline was Turkey, which added 100,000 tonnes in 2021/22. Exports to India, Canada’s other big customer, dropped by more than half to roughly 300,000 tonnes and that weakness actually started before the 2021 drought hit. Other sharp cutbacks were seen in other price-sensitive Asian countries, especially Bangladesh, Sri Lanka and Pakistan.

For 2022/23, lentil exports should be able to rebound although the disappointing 2022 Canadian yields will cap the recovery. The more moderate prices should allow some of the price-conscious buyers back into the market while Turkish demand could slip due to a better domestic crop. India is always the big question for lentils and that outlook will only take shape once its rabi crop is planted and develops over the winter. The other factor that will limit demand, particularly for Canadian red lentils, is the record crop taking shape in Australia.

There could also be some longer-lasting effects from the trade disruptions in 2022/23. High prices tend to encourage other countries to respond by increasing production. This includes some export competitors and, in some cases, pulse importers. Threats to food supplies can also cause importers to lower trade barriers and encourage new trade patterns, as seen between China and Russia. If these shifts become entrenched, Canadian pulse exports could face strong headwinds down the road.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.