Pulse Market Insight #218 OCT 14 2022 | Producers | Pulse Market Insights

How Will US Pulse Crops Affect the Markets?

Because Canada is a dominant exporter of several pulses, the size and quality of crops here are important for setting the market “tone”. That said, pulse production just south of the border can also have an influence on markets, especially following the extremes of 2021/22.

Pulse crops on both sides of the border bounced back in 2022 after last year’s disaster, but the pulses with more acreage in Montana and western North Dakota were in tough again this year. The same dryness that hurt the crop in parts of the southern prairies was also felt in areas of the US northern plains, maybe even more. The effect of disappointing US pulse production varies by crop.

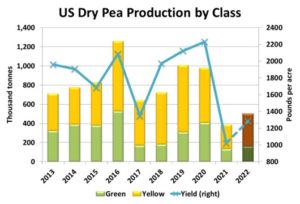

Early on, there had been high hopes for a big pea crop in the US. Initially, the USDA had reported over a million acres of peas were seeded and with average yields, production would have doubled. Later, the planting estimate was cut to 914,000 acres but the bigger disappointment was a yield of only 21.3 bu/acre, for a crop of only 500,000 tonnes.

This second straight small US pea crop will add more demand for Canadian peas. Back in 2021/22, the US imported a record amount of nearly 400,000 tonnes of peas. Based on the earlier optimistic US crop forecast, it looked like its imports would drop off but now, they could be nearly as large again in 2022/23.

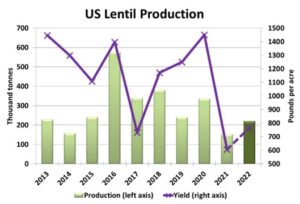

The US lentil crop was also a serious disappointment. Seeded area was down slightly in 2022 and yields really took a hit (again) at only 766 pounds (12.8 bushels) per acre. The result was another small crop of only 220,000 tonnes, well below the pre-2021 average.

The effect of a small US lentil crop is different than for peas. The US doesn’t import a lot of lentils but is a competitor on the export side, specifically for green lentils. In fact, Canada and the US are really the only two green lentil exporters of size. As a result, a shortfall in the US crop means a drop in export availability. This tends to shift more demand toward Canadian lentils, even though the US grows mainly medium greens versus the large and small greens in Canada. There won’t be any real impact for the red lentil side of the market.

Chickpea yields in the US were also disappointing at only 1,120 lb/acre, resulting in a crop of 178,000 tonnes. That’s only about half the pre-2021 average production in the US. In the last few years, the US has become a major importer of Canadian chickpeas and this smaller crop will mean another year of strong demand from south of the border.

The US is dominant in the North American dry bean market. Because the majority of dry beans are grown outside of the 2022 drought area in the northern plains, yields weren’t affected this year. In fact, the USDA is forecasting almost record yields for dry beans. The crop still won’t be huge though because of a 10% drop in 2022 seeded area. Total dry bean production is pegged at 1.09 mln tonnes, 6% more than last year but roughly 100,000 tonnes below average.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.