Pulse Market Insight #219 OCT 28 2022 | Producers | Pulse Market Insights

Start of India’s Rabi Season Could Affect Markets

Even though India has become less important for the pea market, the rabi (winter) growing season is still important for Canadian pulses. That’s because it’s the time of year when Indian farmers plant lentils, peas and chickpeas, the same pulses grown in Canada.

In general, rabi planting starts in late October or early November and runs until late December or early January. Depending on the crop, harvest can begin as early as February and go until April. Lentils and peas are mostly grown in north-central and northeastern parts of the country. Desi chickpeas are grown in a wider area while kabulis are mostly produced in Madhya Pradesh in north-central India. The scale of Indian pulse production can be eye-opening, with total pulse area around 35-40 mln acres every rabi season.

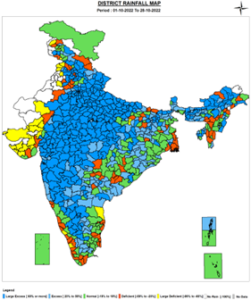

The rabi season is the drier part of the year, coming after the summer (kharif) monsoons. As such, rabi crops depend on soil moisture from the monsoon season to get a good start. This year, the monsoon rains stuck around longer and were heavier than usual, keeping moisture levels high. Nearly the entire country had above-average rain in October. This may have even caused some planting delays, although nothing serious (yet).

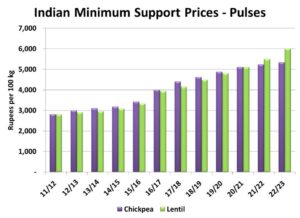

At this point in the season, the Indian government is trying to influence farmers’ decisions with its Minimum Support Prices. Recently, new MSPs were announced, with a large 9% jump for lentils. The new rate of 6,000 rupees per 100 kg works out to roughly C$1,000 per tonne. This is still lower than the domestic market, currently at 6,700-6,900 rupees per 100 kg, so the impact may be muted.

The incentive for planting desi chickpeas wasn’t as positive, with only a 2% increase, now at 5,335 rupees, the equivalent of C$890 per tonne. Even though the chickpea MSP didn’t rise as much, it’s still above the domestic market, currently around 4,850-5,000 per 100 kg, and may still encourage plantings. There is no MSP for peas.

It’s too early in the season to see whether Indian farmers are actually changing their planting plans. We have seen anecdotal reports that lentil (red) plantings could be up 5-7% over last year. If that’s the case and conditions remain favourable, it won’t be helpful for Canadian export prospects. Of course, it’s still too early to draw firm conclusions.

For chickpeas, earlier indications were that fewer acres would be planted and it’s not clear yet if these new higher MSPs will reverse that direction. If there is a sizable decline in seeded area and yields aren’t great, it’s possible that the Indian government could lower import restrictions on chickpeas and (maybe) peas. Currently though, prices for both of those pulses are on the weak side so there’s no incentive yet for the Indian government to open the border for imports.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.