Pulse Market Insight #224 JAN 20 2023 | Producers | Blog Post

Latest US Pulse Crop Estimates

Last week, the USDA issued the Crop Production Annual report, its final (and for some crops, its only) estimates of production for the year. These estimates use the latest numbers from farmers’ acreage declarations to participate in farm support programs and survey results for yields. Although these numbers aren’t perfect, they’re the most complete and the closest to reality.

The size of US pulse crops is important for the Canadian market for a couple of reasons. For some pulses, the US is a key customer of Canadian product and the crop size has an impact on its import needs. For some others, the US competes as an exporter, so its crop availability can affect Canadian export potential.

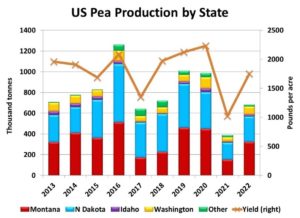

The 2022 US pea crop was pegged at 685,000 tonnes, with Montana and North Dakota as the two main producers. Despite a 6% drop in acreage, the 2022 crop is up 75% from last year’s low on a yield of 1,750 pounds (29.2 bushels) per acre. Even so, this is still well below the pre-2021 average crop of 924,000 tonnes. The US normally uses 750-800,000 tonnes of peas for domestic use, so this smaller 2022 crop means large imports (mostly from Canada) will be needed for the second straight year and its exports will need to be cut back.

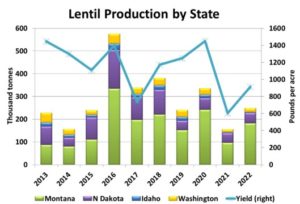

The USDA estimated the 2022 lentil crop at 249,000 tonnes, 61% larger than last year even though acreage was 7% smaller. The lentil yield of 912 lb/acre was well below average but enough of an improvement to boost the crop size. Similar to peas, this lentil production was an improvement over the 2021 disaster but was still lower than the pre-2021 average crop of 375,000 tonnes. The smallish US crop may not trigger extra imports, but it looks like exports will be below average in 2022/23. Because medium greens are the largest part of US lentil production, a cutback in exports would support demand for Canadian green lentils.

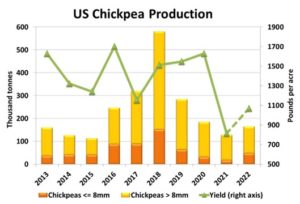

Because most US chickpeas are grown in Montana, where conditions were very dry again in 2022, last summer’s yield and production was very disappointing (again). Total crop size was set at 166,000 tonnes, 28% better than 2021 but only about half the pre-2021 average, with a 1,070 lb/acre yield far below normal. The US is frequently one of the largest importers of Canadian chickpeas, so another small crop will tend to boost that trade, while restricting US exports.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.