Pulse Market Insight #225 FEB 3 2023 | Producers | Pulse Market Insights

Mid-Season Performance Scorecard

There’s been a lot of market activity already this year and over half the crop has been moved into the handling system. Pulse exports are typically front-loaded early in the year, especially the first couple of months after harvest. But there are still six months left in 2022/23 to decide what to do with the rest of the crop. So it’s a good time to measure how pulse crops have performed so far, since this can provide clues about how things could turn out.

The most current market information comes from the Canadian Grain Commission, including information about farmer deliveries, shipments from country elevators and exports. The CGC data doesn’t include every tonne being sold or moved but is a helpful measure, especially comparing this year to prior years. Because of the abnormal situation caused by the 2021 drought, comparisons to 2021/22 aren’t all that helpful so we’ve included 2020/21 and a 5-year average in this discussion.

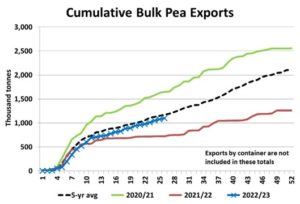

Farm deliveries of peas into licensed elevators through the first half of 2022/23 are 1.725 mln tonnes, half the 2022 crop. That’s 500,000 tonnes more than last year’s crop but 150,000 tonnes less than the 5-year average. Keep in mind the 2022 crop was smaller than average, so deliveries as a percent of on-farm supplies is right in line with average.

It’s a similar story for exports. Pea exports reported by the CGC (mainly bulk vessel shipments) are 1.1 mln tonnes, well above last year but a bit behind the average pace. It’s also much less than 2020/21, when Canadian supplies were plentiful and Chinese demand was very strong. This year is different, on both counts.

This delivery and export performance is steady but not spectacular. That’s the main reason bids have largely been moving sideways since last fall. Unless the pace picks up in the second half of 2022/23, supplies will be large enough to satisfy demand with adequate ending stocks. If so, there’s not likely much price upside in the short to medium term.

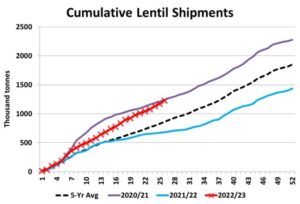

Lentil movement has been considerably better, with farmers delivering 1.23 mln tonnes to licensed elevators through the first half of 2022/23. That’s well ahead of both last year and the average pace and is catching up to the stronger 2020/21 pace. Lentil shipments out of elevators (shown below) are still running strong and have now caught up to 2020/21, even though this year’s supplies are about 600,000 tonnes smaller.

This strong flow of lentil deliveries into elevators and shipments out to export positions means lentil supplies are getting drawn down at a faster pace than usual. That sets the stage for tighter ending stocks for 2022/23.

There are no guarantees the second half of the marketing year will turn out the same as the first half. Production in other countries and demand from importers can (and probably will) change the outlook. Still, the first half has set the tone and the supplies remaining for the second half are looking more certain.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.