Pulse Market Insight #229 MAR 31 2023 | Producers | Pulse Market Insights

Shifting Trade is a Risk for Peas

It’s no secret that since India disappeared as an importer of peas, China has become Canada’s most important customer. Back in 2016/17, China took roughly a quarter of Canadian pea exports, but that market share rose to 72% in 2020/21, dropping to 66% in 2021/22. So far in 2022/23, China is still responsible for 55% of Canadian pea exports. And when it comes to yellow peas, China is even more dominant, averaging around 80% in the last couple of years.

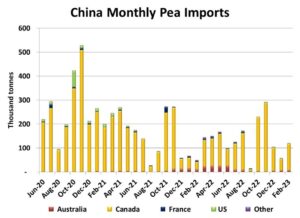

The flipside is even more noticeable; China is extremely dependent on Canadian peas. Aside from the 2021/22 drought year, over 90% of Chinese pea imports have come from Canada. At times, China has sourced some peas from the US, France and Australia but Canada is overwhelmingly the largest origin.

Because of this concentration, both sides of the trade have considerable risk. If Chinese pea imports drop, either because total demand is lower or other sources are found, Canadian pea exports are very vulnerable. Likewise, as the 2021/22 drought year showed, Chinese buyers have few other options if Canadian peas are not available. The small Canadian crop caused prices to spike and Chinese feeders dropped out of the pea market entirely, leaving only food and fractionation demand.

Just as it’s in the best interest of the Canadian pea industry to diversify export destinations, China is looking for other options. In 2021/22, China started buying more peas from Australia but was limited by the smaller size of the Australian crop. Around a year ago, we also started to hear about negotiations between China and Russia to lower phytosanitary barriers which would allow Russian peas into China.

These negotiations were finalized a few months ago, but Russian exporters needed to go through a certification process that would let them participate in the trade. That process has taken time, but numerous exporters have now been approved. So far, we haven’t seen any evidence in the Chinese import data that Russian peas are entering the country, but it’s likely only a matter of time.

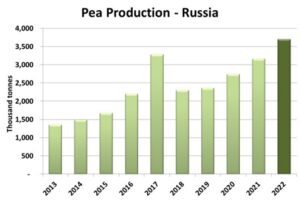

Russian pea production has ramped up the last few years and in 2022, the 3.7 mln tonne crop topped Canadian production of 3.4 mln tonnes. Part of the attraction for Russian farmers has been that peas are not subject (yet) to export taxes. In the past, the vast majority of Russian peas were consumed domestically, mostly in the feed industry with exports mainly going to western Europe, again as feed.

Some observers have suggested China’s certification process for Russian peas will limit the volume of trade between the two countries. While that’s likely true, even a few hundred thousand tonnes would allow Chinese buyers to play one origin off against the other. Canada may have an advantage in terms of quality, but this would still tend to dampen demand. The bottom line is that this shift in trade would be a considerable risk for Canadian peas, especially yellows.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.