Pulse Market Insight #228 MAR 17 2023 | Producers | Pulse Market Insights

How Many Acres Are Enough?

At this time of year, there are plenty of ideas about seeded area of pulse crops for 2023. We have our own guesstimates and other companies have their sets of numbers as part of their planning processes. We have access to a few of those but there are many that we don’t see.

It’s interesting how some people are very convinced they have the right acreage numbers but in reality, there’s always a certain amount of guesswork in forecasting seeded area. There’s a bit of “art” to go along with the science. Because of this uncertainty, we like to compare a few estimates to see how they could affect the outlook for 2023/24.

For peas, our latest guesstimate of 2023 seeded area is 3.05 mln acres, toward the lower end of the estimates we’ve seen. Other numbers range all the way up to 3.50 mln acres and of course some are between those two extremes. Just as reference, seeded area in 2022 was 3.37 mln acres, the third straight year that acreage declined.

At this point in the year, we can’t really forecast 2023 yields. Some areas of the prairies that look better and some look worse at this time a year, and that can change quickly. The best odds are that yields will come in close to average. Our approach at this stage is to use an “olympic average” of the last five years, dropping the low and the high yields and averaging the other three years. This results in a 37.3 bu/acre yield estimate for peas, a half bushel lower than the 2022 yield of 37.8 bu/acre.

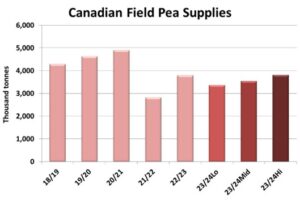

If we apply that yield against low, medium and high acreage estimates, next year’s pea supplies would range from 3.36 mln tonnes to 3.81 mln tonnes. That difference of 450,000 tonnes may not look like much on the chart but, with total usage in 2022/23 expected at 3.5 mln tonnes, the low end of estimates would mean there wouldn’t be enough peas to keep up with demand. At the high end, 2023/24 supplies would be unchanged and as long as demand is similar, the outlook would be stable.

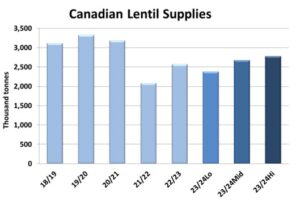

The range of acreage estimates (that we’ve seen) for lentils in 2023 goes from a low of 3.60 mln acres to 4.28 mln acres, all lower than 2022 at 4.32 mln acres. Our own guesstimate is somewhere in the middle at 4.10 mln acres. If yields this summer would bounce back to the olympic average of 1,310 pounds (21.8 bushels) per acre (versus 1,197 lb/acre in 2022), supplies would range from 2.38 mln tonnes up to 2.77 mln tonnes. This compares with the 2022/23 supplies at 2.57 mln tonnes.

Clearly, the acreage outcome will have a lot to say about how next year’s lentil market will unfold. Total usage of lentils in 2022/23 is estimated at 2.37 mln tonnes, which means the low acreage number would mean just enough lentils would be produced in 2023/24 to meet demand, but with no carryover (which clearly can’t happen). Meanwhile, the high end would provide a bit more breathing room but wouldn’t be heavy.

Of course, all these acreage estimates won’t mean much if yields are a lot different than the average. A change of two or three bushels per acre can offset quite a few acres, either higher or lower. Clearly, the acreage estimates shown above aren’t the last word on the 2023/24 market outlook.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.