Pulse Market Insight #232 MAY 26 2023 | Producers | Pulse Market Insights

All Eyes on the Weather

Weather is and always will be the dominant driver of crop markets. That’s obvious. All other factors – geopolitics, trade wars, government policy, hedge funds – take a back seat to rainfall and temperatures. This time of year is the most critical, as crops emerge and yield potential is already being determined.

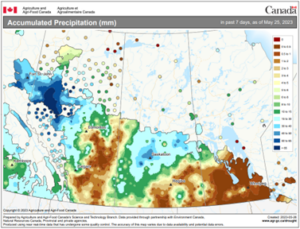

While every growing season is different, western Canada has seen extremes in the past 3-4 years. In some areas, 2020 was already a drought year, which then widened and deepened in 2021. Most, but not all, areas saw relief in 2022. The 2023 growing season started with widespread concerns about dryness, especially in central and northern areas that are typically wetter at the beginning of the year. Just in the past week though, welcome rains fell in northwest Alberta and north central Saskatchewan. But that still leaves large parts of Alberta facing dry conditions as the crop emerges.

Because it’s still extremely early and conditions are highly variable, there’s a wide possibility of crop outcomes which would have a large impact on market direction. Keep in mind, there’s still plenty of debate about the number of acres planted, due to StatsCan’s unusually early acreage survey. But if we use StatsCan’s seeded area estimates, we can develop some scenarios based on different yields.

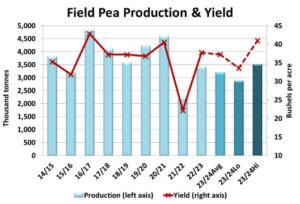

At this stage of the year, the best odds are for an average yield, and that’s our base case. The average pea yield is 37.3 bu/acre and that would produce a 3.2 mln tonne crop. That’s lower than last year and well off pre-2021/22 levels. If we pencil in a 33.5 bushel yield, 10% below average, the crop drops below 2.9 mln tonnes while a 10% above average yield of 41.0 bu/acre would mean a crop a bit more than 3.5 mln tonnes.

On the chart, these scenarios look fairly close but a 600,000 tonne difference from the low end to the high end would have a large impact on the outlook. A lot also depends on export demand and domestic use, but the smaller crop means buyers would need to get more aggressive to lock in supplies. At the high end, 2023/24 supplies would be more comfortable than the current year and prices could drift sideways or even lower.

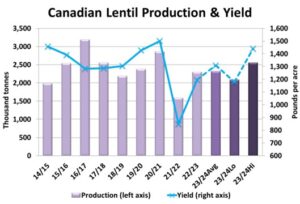

It’s a similar situation for lentils. The production differences don’t look all that large on the chart, but the low yield scenario with a crop under 2.1 mln tonnes and the high end at 2.55 mln tonnes would result in very different outcomes. An important reminder for the lentil market is that the carry-in supplies from 2022/23 will already be very low and a larger crop is needed just to rebuild inventories. This makes the lentil market more vulnerable to crop problems in 2023.

In the end, our hope is that all pulse growers achieve good returns this year, whether that’s through higher yields or strong prices. Or even better, a bit of both.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.