Pulse Market Insight #238 SEP 15 2023 | Producers | Pulse Market Insights

Limited Supplies the Main Factor for 2023/24

There’s been a flurry of information coming out of StatsCan the last few weeks. In our previous Pulse Market Insight, we talked about StatsCan’s initial crop estimates, and it has already issued another update based on satellite vegetation images from the end of August. Last week, StatsCan also issued its estimates of July 31 ending stocks, including supply and disposition tables for each crop. The combination of carryover from 2022/23 and the 2023 crop provides an idea of supplies for 2023/24, although there are always questions about the data.

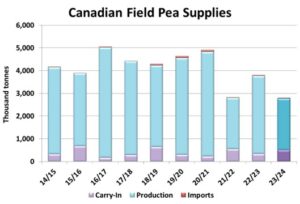

For peas, StatsCan reported July 31 inventories just under 500,000 tonnes, including 300,000 tonnes in farmers’ bins. This is on the higher side of recent history but in reality, it’s still only a small part of 2023/24 supplies. These larger stocks aren’t as important this year, given the big drop in the 2023 crop. These carryover supplies help offset some of the production decline but certainly not all of it.

StatsCan’s added a bit to the 2023 pea crop in its latest estimates, now at 2.27 mln tonnes versus 2.19 mln back in August. This is still 34% smaller than last year and only slightly larger than the 2021/22 crop. The combination of old-crop carryover and 2023 crop means supplies of 2.8 mln tonnes, almost a million less than last year and in line with 2021/22. Based on acreage data, we expect supplies of green peas to be relatively tighter than yellows.

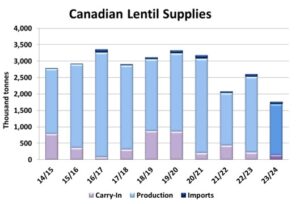

The picture for lentils is similar but a little tighter yet. StatsCan reported 2022/23 lentil ending stocks at only 147,000 tonnes, one of the smallest in the last 10 years. This seems a little too low, as it means only 28,000 tonnes on-farm, which doesn’t quite fit with feedback we’ve heard from farmers about lentils still sitting in bins. Ultimately though, the exact size of that carryover number isn’t going to be the most important factor for 2023/24 lentil supplies.

StatsCan’s latest estimate of the 2023 lentil crop was 1.54 mln tonnes, almost unchanged from its previous number and down a third from last year’s crop. With the low carryover from 2022/23, lentil supplies for 2023/24 would be only 1.76 mln tonnes, 320,000 tonnes less than the 2021/22 drought year. Within these very low supplies, it’s likely that red lentils will be relatively tighter than greens.

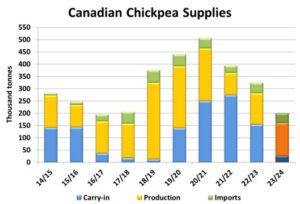

StatsCan has reported a 2023 chickpea crop at 134,000 tonnes, actually larger than last year due to a 35% increase in seeded area. In the case of chickpeas, the bigger story is the 2022/23 ending stocks, which StatsCan pegged at only 25,000 tonnes. While that’s probably too low and should be revised higher, it will still mean supplies for 2023/24 will be the smallest in at least five years.

These tight supplies for all three pulses certainly provide a friendly price outlook for 2023/24. The demand side of the equation is very important too and is something to be talked about in future reports.

Pulse Market Insight provides market commentary from Chuck Penner of LeftField Commodity Research to help with pulse marketing decisions.